Provincial Budget 2024

Highlights from the Ontario Budget

Minister of Finance Peter Bethlenfalvy tabled the 2024/25 Ontario provincial budget on March 26, 2024. Ontario continues to face economic challenges and elevated uncertainty. The outcomes of persistently high interest rates and inflation continue to be unclear. Ontario’s economy, however, has demonstrated continued resiliency in light of ongoing economic pressures.

In 2023/24, Ontario is projecting a deficit of $3.0 billion. Over the medium term, the government is projecting deficits of $9.8 billion in 2024/25 and $4.6 billion in 2025/26 before planning for a surplus of $0.5 billion in 2026/27. Real gross domestic product (GDP) growth is projected to slow from an estimated 1.2% in 2023 to 0.3% in 2024. Thereafter, it is projected to increase to 1.9% in 2025 and 2.2% in 2026 and 2027.

On the income tax side, there were no proposed increases or decreases to personal or corporate income tax rates. The budget did announce extended gas and fuel tax rate cuts, a vacant homes tax for municipalities, and a strengthened non-resident

speculation tax.

Here are a summary of proposals announced in the budget. Please note that these measures remain proposals until passed into law by the provincial government.

Personal Tax Matters

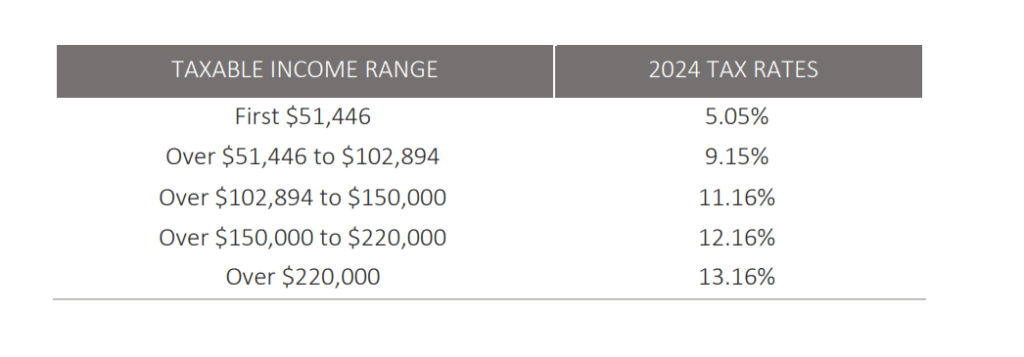

Personal income tax rates and tax brackets

There were no changes to personal income tax rates announced in the budget. Tax brackets and other amounts have been indexed by 4.5% to recognize the impact of inflation, except for the $150,000 and $220,000 brackets, which are not indexed for inflation. The table below shows the Ontario tax rates and brackets for 2024.

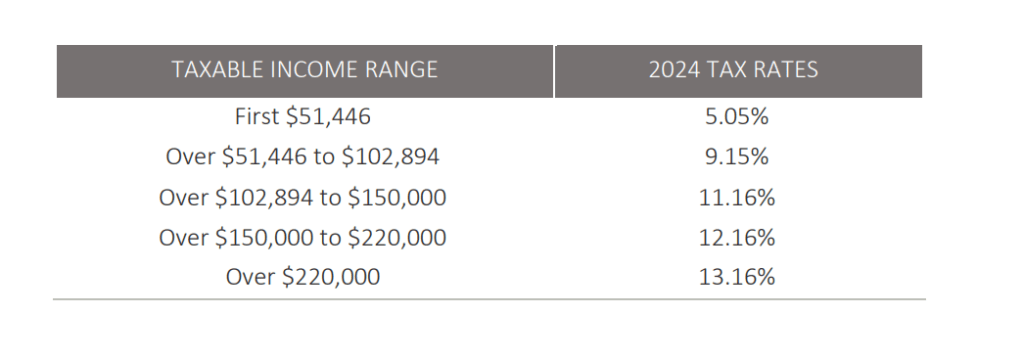

The table below shows the 2024 combined federal and provincial highest marginal tax rates for various types of income

Corporate Tax Matters

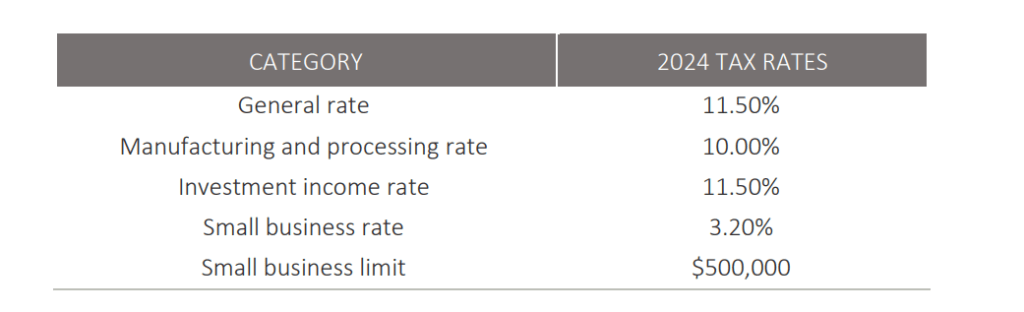

Corporate income tax rates

There were no proposed changes to corporate income tax rates. The table below shows the Ontario tax rates and the small business limit for 2024.

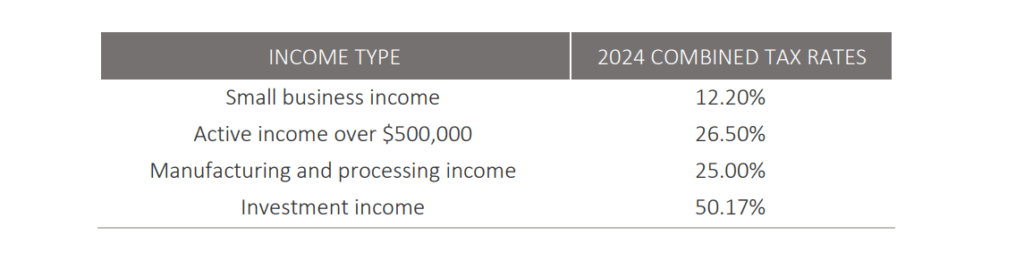

The table below shows the 2024 combined federal and provincial corporate income tax rates for various types of income earned by a Canadian Controlled Private Corporation (CCPC).

The Ontario Computer Animation and Special Effects Tax Credit

The Ontario Computer Animation and Special Effects (OCASE) Tax Credit is an 18% refundable corporate income tax credit available to companies that undertake computer animation and special effects activities on eligible film and television productions in Ontario. To be eligible for the OCASE Tax Credit, a film or television production must also be certified for either the Ontario Film and Television Tax Credit or the Ontario Production Services Tax Credit, “tethering” the OCASE Tax Credit to these other film and television tax credits.

The government is proposing to remove this tethering requirement and replace it with the following new eligibility rules to ensure the credit continues to only support professional productions:

- Subject to conditions, a qualifying corporation would be required to incur a minimum of $25,000 in Ontario labour expenditures for each film or television production for which the OCASE Tax Credit is claimed; and

- Certain types of productions would be excluded from eligibility, including, but not limited to, instructional videos, music videos and gaming videos.

The new rules would be effective for productions for which the qualifying corporation commences computer animation and/or special effects work on or after March 26, 2024.

Other Intiatives

Extending Gas Tax and Fuel Tax Rate Cuts

The Ontario government temporarily cut the gasoline tax rate by 5.7 cents per litre and the fuel tax (diesel) rate by 5.3 cents per litre on July 1, 2022. The gasoline tax and fuel tax rates are currently 9 cents per litre. These tax reductions are set to end on June 30, 2024, when the tax rates would return to 14.7 cents per litre for gas and 14.3 cents per litre for fuel.

The government is introducing legislation to extend the rate cuts so that the rate of tax on gas and fuel would remain at 9 cents per litre for an additional six months until December 31, 2024.

Alcohol Taxation and Fees

The government is proposing to eliminate the wine basic tax that applies to sales of Ontario wine and wine coolers in on-site winery retail stores. The new rate would come into effect on April 1, 2024.

The government will also conduct a targeted review of taxes and fees on beer, wine and alcoholic beverages with the aim of promoting a more competitive marketplace for Ontario-based producers and consumers.

A Vacant Homes Tax for Municipalities

Ontario is extending authority broadly to all single- and upper-tier municipalities to impose a tax on vacant homes with the goal of increasing housing supply and addressing housing affordability. Municipalities will be supported with a new provincial policy

framework that sets out best practices for implementing a Vacant Home Tax. The framework will also encourage municipalities to set a higher Vacant Home Tax rate for foreign-owned vacant homes.

Strengthening Non-Resident Speculation Tax (NRST)

Ontario’s Non-Resident Speculation Tax (NRST) is a tax applied at the time of a home purchase by a foreign entity. Budget 2024 announces that the government is taking action to strengthen the NRST with amendments to support compliance and improve

fairness. In addition, the government is taking steps to increase information sharing between provincial, federal and municipal governments.

Allowing for Lower Taxes on New Purpose-Built Rentals

To further encourage the development of purpose-built rental properties, effective immediately, Ontario is providing municipalities with the flexibility to offer a reduced municipal property tax rate on new multi-residential rental properties.

Implementing a Target Benefit Pension Plan Framework

Target benefit pension plans provide a monthly stream of income in retirement at a predictable cost for employers. Multiemployer pension plans that provide target benefits are often created by a union or association within a specific industry, especially industries involving the skilled trades. The government has been engaging with the sector over the past year on a permanent target benefit framework that builds on

best practices for plan funding and governance and enhances communication with plan members. The government is now drafting proposed regulations that would support the framework. These proposed regulations will be made available for technical review by the sector in the summer of 2024. The government is also proposing legislative amendments that would support the implementation of the framework. The government intends for the permanent target benefit framework to come into effect on January 1, 2025.

Ontario Tax System Review

In Budget 2023, the government announced a review of the province’s tax system. Since then, the government has consulted with tax experts, economists and business leaders. Based on input from the consultations, the tax system review will focus on opportunities to update the tax system to support greater productivity, to promote fairness, to enable greater simplicity and

transparency, and to modernize administration.

Technical Amendments

Budget 2024 proposes legislative amendments to:

- the Estate Administration Tax Act, 1998 to include the term “small estate certificate” and “amended small estate certificate” under the definition of the term “estate certificate”; and

- the Financial Administration Act to provide express authority for intra-day credit for loans entered into by the province of Ontario.