March 2025 Portfolio Construction

By Alfred Lam, MBA, CFA, Senior Vice-President & Chief Investment Officer, CI GAM | Multi-Asset Management & Richard J. Wylie, MA, CFA, Vice-President, Investment Strategy, CI Assante Wealth Management

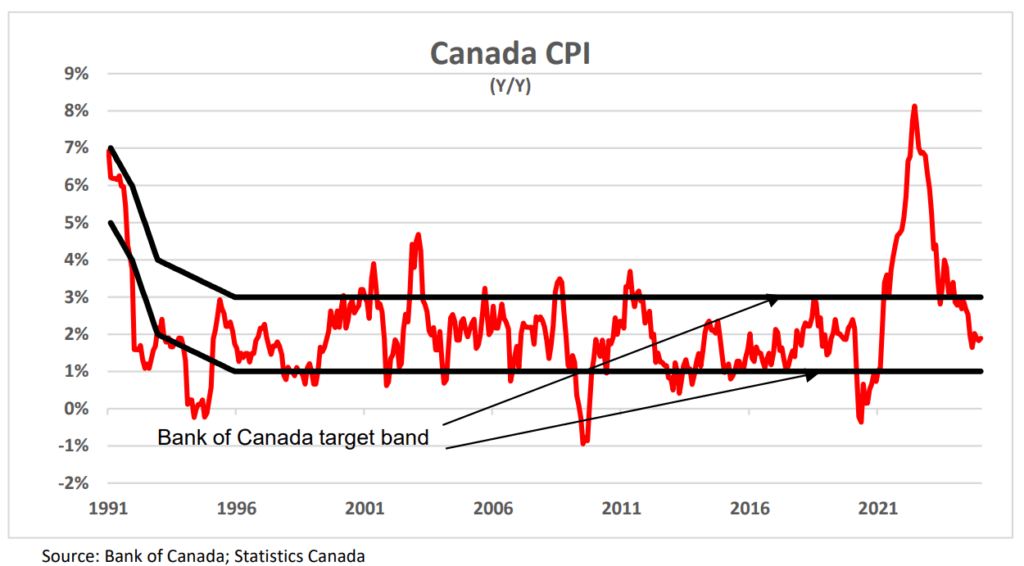

Canadian inflation – calm before the storm?

Tariffs threaten Canada’s inflation rate.

The latest data from Statistics Canada revealed that its consumer price index rose 0.1% (seasonally adjusted) in January. As can be seen in the accompanying graph, the CPI was up 1.9% on a year-over-year basis. This figure is marginally higher than the 1.8% pace posted in December and was the thirteenth consecutive monthly reading inside the Bank of Canada’s 1%–3% target band. The three Bank of Canada core inflation measures reported generally higher results in January. They ranged from 2.2% to 2.7%. CPI common, which the central bank says is most closely correlated with the output gap, stood at 2.2% in this report. In line with the

monthly advance, four of the eight main CPI subgroups moved higher during December. Clothing recorded the largest (0.9%) monthly advance. Meanwhile, alcoholic beverages, tobacco products and recreational cannabis saw the largest of the four declines (-1.4%) amid the GST/HST “holiday”. The reversal of these tax incentives will see prices rise commensurately as they come off. More importantly, any countervailing tariffs on U.S. goods will also heavily influence consumer prices going forward. At present, the Canadian dollar is under heavy pressure in international trading. Given the recent bout of food price inflation, any tariffs on imported food that come into force while the currency is this weak will magnify the price impact. The market will, once again, weigh the chances of another rate cut by the Bank of Canada at its next policy announcement, on March 12, 2025, as this will put additional downward pressure on the loonie.

U.S. labour market remains firm

The U.S. Bureau of Labor Statistics announced that the unemployment rate edged lower to 4.0% in January from 4.1% in December. At the same time, non-farm payroll gains were reported as 143,000 during the month, adding to the revised 306,000 gain posted for November (originally reported as 256,000). This extended the string of consecutive monthly payroll gains to 49.

Additionally, average hourly earnings climbed 0.5% in January to stand with a year-over-year advance of 4.1%, above headline inflation. The consumer price index recorded a 3.0% annual advance in January, the largest 12-month increase since June 2024.

The clear resilience of the U.S. job market coupled with the recent rise in inflationary pressure will prompt further market debate on the probability that the Fed will remain “on hold” at their next policy meeting, scheduled for March 18 and 19.

Longer View

The experiments of spending now and worrying later have proven to be too costly. Additionally, pursuing “green” initiatives at any price has contributed to deteriorating economic conditions in Canada. Both Americans and Canadians are calling for new governments that will prioritize “common sense” policies. It is expected that the interest rate gap between Canada and the U.S. will remain wide for some time, as the Bank of Canada will need to cut rates more quickly to improve competitiveness. Bond yields indicate a 1.4% gap over the next 10 years, which will likely result in a weaker Canadian dollar.

Hundreds of billions of dollars are being invested in artificial intelligence initiatives aimed at boosting productivity, increasing earnings, enhancing lifestyles and creating new industries. The next big development on the horizon is “full self-driving” technology, which will revolutionize the transportation ecosystem, from ownership and storage to usage and safety. Imagine reaching your destination with the touch of a button. Just as the iPhone changed the way we communicate, full self-driving could transform the way we commute.

Disclaimer

The information contained herein consists of general economic information and/or information as to the historical performance of securities, is provided solely for informational and educational purposes and is not to be construed as advice in respect of securities or as to the investing in or the buying or selling of securities, whether expressed or implied. These statements reflect what CI Assante Wealth Management (“Assante”), and the authors believe and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments. Neither Assante nor its affiliates, or their respective officers, directors, employees or advisors are responsible in any way for any damages or losses of any kind whatsoever in respect of the use of this document or the material herein. CI Assante Wealth Management is a registered business name of Assante Wealth Management (Canada) Ltd. CI GAM Multi-Asset is a division of CI Global Asset Management, a subsidiary of CI Financial Corp. CI Global Asset Management is a registered business name of CI Investments Inc. This document may not be reproduced, in whole or in part, in any manner whatsoever, without the prior written permission of Assante. ©2025 CI Assante Wealth Management. All rights reserved