March 2024 Portfolio Construction

Market Focus

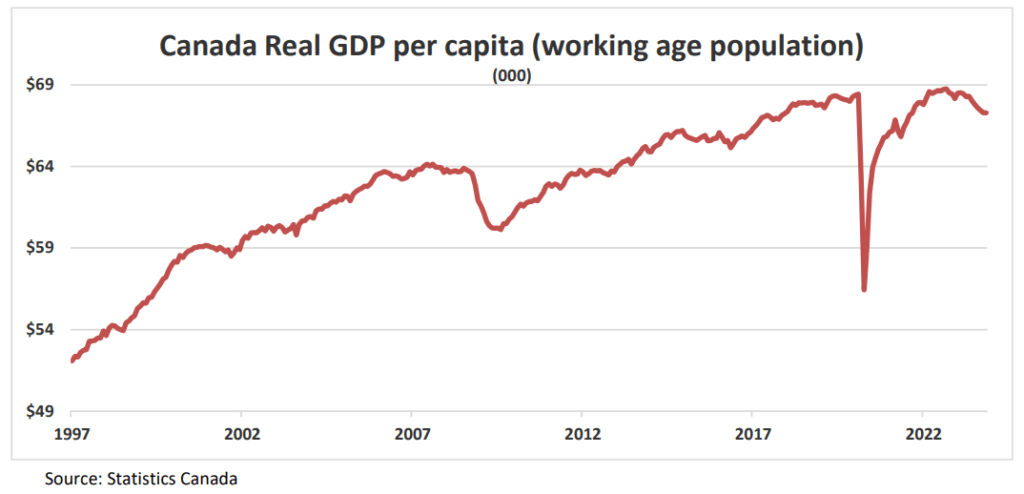

Canada’s standard of living continues to decline. Canada’s economic output was soft in 2023. Statistics Canada announced that, on a monthly basis, real gross domestic product (GDP) by industry expanded by 0.2% in November, following “flat” results in each of the previous three months.

In addition, in this report the statistics agency provided revisions going back to January 2023, which lowered total economic output for the entire year. While the Canadian economy has, thus far, been able to narrowly avoid a technical recession (two consecutive quarters of negative growth), it has clearly softened. As can be seen in the accompanying graph, GDP per-capita (working aged individuals) declined again in November and stands with an annual contraction of 1.7%. In fact, on this basis there have been only three months of real output growth in the last fourteen. This represents a material decline in Canada’s standard of living and has occurred despite relative strength in the job market. Further, the prolonged stretch of higher interest rates and weak business investment is expected to limit growth for an extended period. It appears likely that, despite the absence of an outright recession, the Canadian economy will record the worst year since the pandemic in 2020.

U.S. productivity stands in stark contrast to Canada

The U.S. Bureau of Labor Statistics announced that non-farm labour productivity grew by 3.2% (annualized) during the fourth quarter of 2024. This adds to the 4.9% advance (on the same basis) recorded in the third quarter. In the U.S., productivity gains have been made in five of the last six quarters and output per worker hour hit a new record high in this latest report. Productivity growth is important for longer-term economic stability as it reflects a country’s competitiveness, allows for higher wages, faster economic growth without inflationary pressures, and a higher standard of living. Unfortunately, Canada has been reporting very poor results by comparison. Canadian productivity contracted by 3.1% (annualized) in the third quarter of 2023 (latest available data). This was the twelfth decline in the prior thirteen quarters. Canada’s output per worker hour has fallen a cumulative 6.0% since the pre-pandemic peak. It remains to be seen if this can be turned around.

Longer View

The Federal Reserve has raised rates aggressively this year and that is expected to cool inflation. The side effects of this strategy are a slowing economy and rising unemployment. Until we know how bad these side effects will be, the markets will remain a “guessing game”. Over the long term, we expect rates to average 2.25-2.5%; this means the 10-year bond at 3.7% yield today is oversold. Stocks will likely continue to benefit from low long-term interest rates and technological advancement. Economic cycles have been short and volatile as they are heavily influenced by dramatic policies. Therefore, investors should not be overly excited or concerned about what they see in the immediate term.

We can help

We work with business professionals, executives, and families to grow and protect their wealth using our Wealth Plan formula. To discuss our approach and if it is the right fit for you, we invite you to schedule a no-obligation discovery consultation.