June 2024 Portfolio Construction

By Alfred Lam, MBA, CFA, and Richard J. Wylie, MA, CFA.

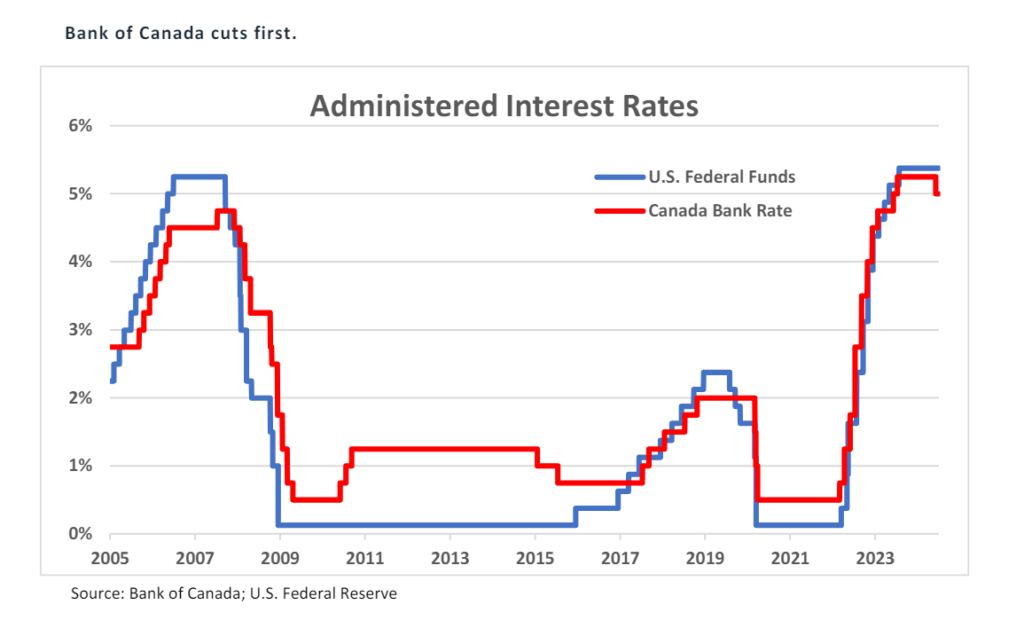

Market participants look for more

The Bank of Canada announced that it was lowering administered interest rates by 25 basis points (a basis point is 1/100th of one per cent) at the conclusion of its June 5 monetary policy meeting. As can be seen in the accompanying chart, the Bank has beaten the U.S. Federal Reserve (Fed) to the punch and the range for overnight borrowing now stands at 4.75% to 5.00% with the official benchmark Bank Rate at 5.00%. This is the first interest rate cut by the Bank since March 27, 2020, and follows interest rate hikes totaling 475 basis points between March 2, 2022, and July 12, 2023. This was the largest set of interest rate increases since November 1987 to May 1990 (596 basis points).

Importantly, the text that accompanied the announcement highlighted the Bank’s concerns over the gap between population growth and employment growth, stating that “employment has been growing at a slower pace than the working-age population.” In addition, “[the] Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.” Stateside, a stronger economy and higher inflation will likely translate into a delay in any rate action until the fall. Another cut by the Bank is anticipated, and the next policy announcement is scheduled for July 24, 2024.

U.S. job growth continues

The U.S. Bureau of Labor Statistics announced that the unemployment rate edged up to 4.0% in May. At the same time, non-farm payrolls gains were reported as 272,000 during the month, adding to the 165,000 gain posted for April. This extended the string of consecutive monthly payroll gains to 41. As well, average hourly earnings climbed 0.4% in May to stand with a year-over-year advance of 4.1%, above headline inflation. The consumer price index recorded a 3.3% annual advance in May, marginally lower than the 3.4% pace posted in April. In addition, core inflation (CPI ex food and energy) also edged down, moving to 3.4% (y/y) in

May from the 3.6% figure in April. Clearly, inflation has moderated but remains stubbornly above the Fed’s 2.0% target, with core inflation at a somewhat higher rate. The combination of still-high inflation coupled with a strong labor market has pushed market

expectations of a rate cut out of the summer and into the fall. The next policy meeting is scheduled for July 30 and 31.

Longer View

Many investors are obsessed about short-terms issues such as near-term inflation, interest rates and economies; they are ignoring the opportunity of a multi-year trend which is the growth of artificial intelligence in business and our everyday lives. We have seen dramatic demand for GPUs that power data centres and enable AI into the gadgets and software that we use. The reality is we will see much more usage and growing market capitalization of the companies that enable and use AI. It is possibly a $15-20 trillion investment opportunity.