January 2024 Portfolio Construction

Alfred Lam, CFA, Senior Vice-President, and Co-Head of Multi Asset, CI Global Asset Management

Our 2024 Wish List

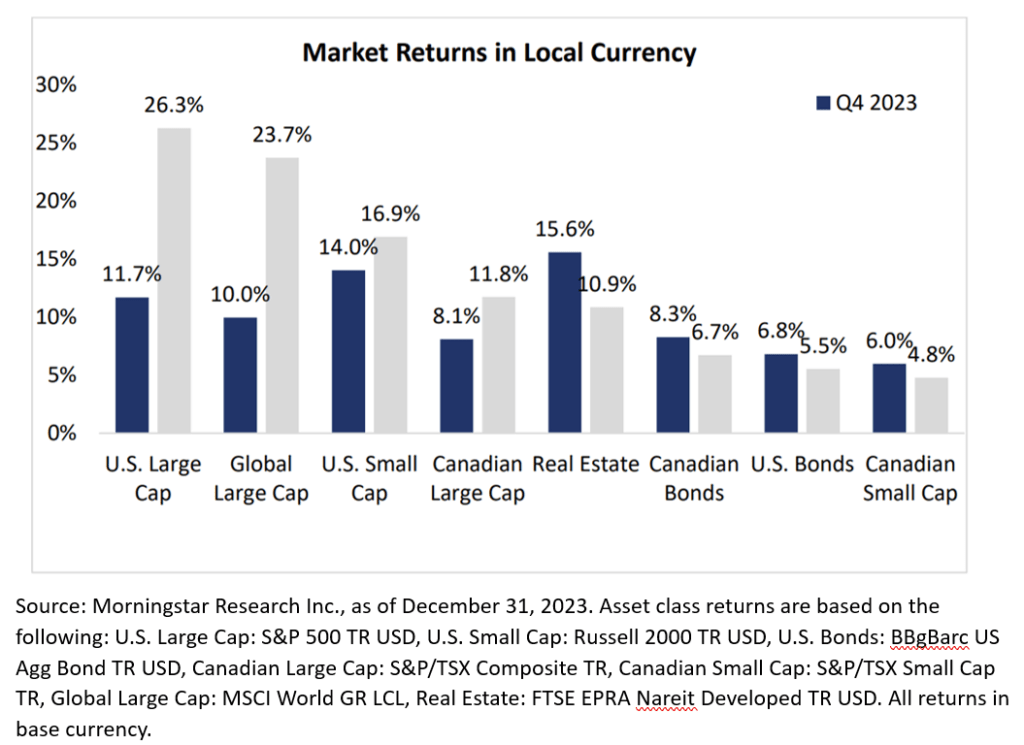

As we enter a new year, we consider the following a “wish list”: lower inflation, lower interest rates, higher investment value and, last but not least, peace! As inflation continues to decline, central banks have signaled their job to battle inflation is almost done and cuts may be coming soon. This change in trajectory ignited a sharp rally in the values of bonds and stocks in the final quarter of 2023 (see the chart below).

In certain asset classes (Canadian bonds, U.S. bonds, real estate, Canadian small caps), the Q4 return turned the full year from negative to positive. This once again reminded investors of the importance of staying invested. The U.S. large cap stocks, as measured by the S&P 500 Index, finished the year at 4783, which is 14 points below the all-time-high recorded on January 3, 2022. High inflation seems to be short-lived, along with high interest rates and

poor stock performance.

So far, it is the consensus that inflation is controlled and rates will be lower as stocks are repricing to represent forward-looking valuations. We will find out if those conditions are met in the coming months of 2024.

Peace is harder to achieve, with at least two ongoing wars and threats of military action by North Korea and China. Yet, we remain hopeful. Our portfolios are generally positioned for the medium to long term rather than the near term. We do have an overweight position in energy due to company specific valuations and cash flows, but not due to geopolitical concerns. We expect companies to

benefit from lowering interest rates, stable economic growth and ongoing innovation.

Speaking of innovation, Apple is expected to launch its Vision Pro headset in the first quarter. This may be the next “hot” gadget to own after the iPod, iPad, iPhone and Apple Watch. Its failure or success will have a direct and significant impact on the S&P 500’s performance given Apple’s significant weight in the Index. Innovation has continued to drive stock prices higher in the U.S., against traditional wisdom that the performance is all due to the economy. Innovation is hard and fierce in competing for dominance in artificial intelligence (AI).

The largest technology giants have all committed to spending on AI initiatives, and that’s hundreds of billions of dollars. This unfortunately leaves small cap companies out of the game. AI chip maker Nvidia is busier than ever trying to meet demand and also upgrading their products to compete. We will hear more as these companies report their Q4 earnings, which will allow us to reassess the “speed of change”. 2024 is set up to be interesting, with less restrictive monetary policies and innovation that may exceed your imagination.

Disclaimers

This document is intended solely for information purposes. It is not a sales prospectus, nor should it be construed as an offer or an invitation to take part in an offer. This report may contain forward-looking statements about one or more pools, future performance, strategies or prospects, and possible future fund action. These statements reflect the portfolio managers’ current beliefs and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments. Every effort has been made to ensure that the material contained herein is accurate at the time of publication. Market conditions may change which may impact the information contained in this document and it is subject to change without notice. The author and/or a member of their immediate family may hold specific holdings/securities discussed in this document. Any opinion or information provided are solely those of the author and does not constitute investment advice or an endorsement or recommendation of any entity or security discussed or provided by CI Global Asset Management. We cannot guarantee its accuracy or completeness and we accept no responsibility for any loss arising from any use of or reliance on the information contained herein. The pools used in the CI Private Wealth portfolios are managed by CI Global Asset Management. Management fees and expenses may all be associated with investments in the CI Private Wealth portfolios and the use of other services. The pools used in the CI Private Wealth portfolios are not guaranteed, their values change frequently, and past performance may not be repeated. You should seek professional advice before acting on the basis of information herein. CI GAM | MultiAsset Management is a division of CI Global Asset Management. CI Global Asset Management is a registered business name of CI Investments Inc. This report may not be reproduced, in whole or in part, in any manner whatsoever, without prior written permission of CI Private Wealth. © 2024 CI Private Wealth, a division of CI Private Counsel LP. All rights reserved. (01/24)