How Past Market Events Changed Investor Behaviour Today

In this month’s Portfolio Construction commentary, Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer and Marchello Holditch, CFA, CAIA, Vice-President and Portfolio Manager of CI GAM | Multi-Asset Management review how our recent memories of the last 2 major market corrections helped to shape how many investors reacted to the COVID-19 market dip.

Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer

Marchello Holditch, CFA, CAIA, Vice-President and Portfolio Manager

CI GAM | Multi-Asset Management

Those of us who have gone through different market regimes would notice investor behaviour today is very different than twenty years ago, or even a decade ago. But that doesn’t mean there aren’t similarities today to past market events.

Let’s look at three significant market events to see how…

1. The tech bubble

What happened?

About twenty years ago we saw the tech bubble and its burst. Initially driven by greed, it eventually burst because of realities – the reality that some companies were overvalued as they had no earnings and no credible plan to do so, and the reality that tighter central bank monetary policy shut new cash flows within the bubble.

Some tech companies did survive and their businesses evolved (Microsoft Corp., Cisco Systems Inc. and Amazon.com Inc.) but many did not. A prime example is Pets.com, which raised US$82.5 million in a February 2000 initial public offering (IPO), only to file for bankruptcy nine months later.

The impact

In total, the Nasdaq Composite Index took 942 days to bottom from its peak – the drawdown was 78%! Over the next 4,546 days, the index recovered to its previous high as new companies were added and others strengthened their business. Over the long term, these events set up a period where investors sought downside protection and diversification.

2. The global financial crisis

What happened?

Moving past the mid-2000s, stock markets became unattractive for short-term gains. Speculators, once again driven by greed, found themselves investing in housing and complicated financial instruments tied to mortgages in the U.S. Like all bubbles, it worked for a while, until it didn’t. Some too-big-to-fail financial giants went bankrupt and rocked the global financial system and stock markets.

The impact

It was here that the concept of the central bank bailout was first introduced. The U.S. Federal Reserve dropped interest rates to zero, an unprecedented move, and introduced “quantitative easing” – the printing of money. When this large amount of “new” money was introduced, it effectively rescued prices. The S&P 500 Index fell 53% but bottomed in less than a year.

It was here that the concept of the central bank bailout was first introduced. The U.S. Federal Reserve dropped interest rates to zero, an unprecedented move, and introduced “quantitative easing” – the printing of money. When this large amount of “new” money was introduced, it effectively rescued prices. The S&P 500 Index fell 53% but bottomed in less than a year.

3. COVID-19

What happened?

In 2020, the world faced a new challenge – COVID-19. Investor confidence collapsed and gross domestic product (GDP) was expected to fall dramatically as people stayed home and many businesses were forced to close. To offset, governments and central banks globally reacted swiftly with trillion dollars of spending, quantitative easing and low interest rates.

The impact

Learning from past experiences, investors quickly foresaw that asset prices were set to rise, regardless of the pandemic. The S&P 500 index fell 34% in 33 days and took 148 days to hit the previous high. That’s only 181 days from peak-to-trough and trough-to-peak – and it was over before there was even a COVID-19 vaccine. Compare this to the 5488 days for the Nasdaq tech bubble recovery.

| Incident | Index | Drawdown | Number of days to bottom | Number of days to recover |

| Tech bubble | Nasdaq Composite Index | -78% | 942 | 4546 |

| Global financial crisis | S&P 500 Index | -53% | 294 | 1277 |

| COVID-19 pandemic | S&P 500 Index | -34% | 33 | 148 |

Source: Bloomberg Finance L.P.

4. Lessons from the past

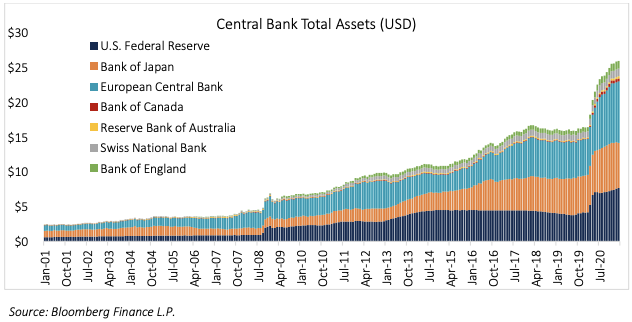

Investor behaviour is driven by recent memory. Two decades ago, investors cared for downside protection – diligent investment selection and diversification – as no one would bail you out if you failed. Since the global financial crisis, investors have become accustomed to central banks providing downside protection so markets can carry on. And they’re not entirely wrong. Money supply as tracked by the balances at major central banks added US$10 trillion dollars in ten years after the global financial crisis. We are on track for another US$10 trillion dollars by end of 2021 to counter the financial impacts of COVID-19 – that’s five times higher than the 2008 level!

5. Lessons for the future

While investors may not have confidence in the economy or their day-to-day life right now, they have learned to be confident in central banks’ ability to prop prices up. But what they should care about is the purchasing power of their money as more is printed and being prepared for when the regime or behaviour changes again. Not all trough-to-peak recoveries are achieved in 148 days. At the end of day, the ultimate goal of investing is to create financial security for the future. Investors need to strike the appropriate balance between protecting their savings against permanent losses while ensuring that they are taking enough risk to achieve the growth required to meet their financial objectives. We believe that active management and strategic asset allocation remain key components to a sound financial plan, even as markets rally. It’s our job to identify and manage all the variables that can influence returns to help keep your clients on track.Combined top 15 equity holdings as of April 30, 2021 of the Assante Private Portfolios 40i60e Standard portfolio with Alpha-style exposure:

- Micorosft Corp.

- Amazon.com Inc.

- Alphabet Inc. (Class A)

- Brookfield Asset Management Inc.

- Mastercard Incorporated

- Taiwan Semicondocutor Manufact Co Ltd

- Alphabet Inc. (Class C)

- Intact Financial Corp

- Facebook Inc

- Royal Bank of Canada

- Apple Inc.

- Tencent Holdings Ltd.

- Ross Stores Inc.

- Prologis Inc.

- Unitedhealth Group Inc.

Source: Bloomberg Finance L.P. and CI GAM | Multi-Asset Management as at April 30, 2021.