Federal Budget 2023: Personal Tax Matters

2023 Federal Tax

Canada’s Finance Minister, the Honourable Chrystia Freeland, tabled the 2023 federal budget on March 28, 2023.

Canada’s economy is now 103% the size it was before the pandemic, marking the fastest recovery of the last four recessions, and the second strongest recovery in the G7. The unemployment rate is near its record low and Canada’s economic growth was the strongest in the G7 over the last year. At the same time, many Canadians continue to face affordability challenges and inflation remains elevated.

Many financial experts estimate that you may need up to 85% of your pre-retirement income in retirement. An employer-sponsored savings plan, such as a 401(k), might not be enough to accumulate the savings you need. Fortunately, you can contribute to both a 401(k) and an IRA. A Fidelity IRA can help you:

Supplement your current savings in your employer-sponsored retirement plan.

Gain access to a potentially wider range of investment choices than your employer-sponsored plan.

Take advantage of potential tax-deferred or tax-free growth.

You should try to contribute the maximum amount to your IRA each year to get the most out of these savings when Investing in IRA. Be sure to monitor your investments and make adjustments as needed, especially as retirement nears and your goals change.

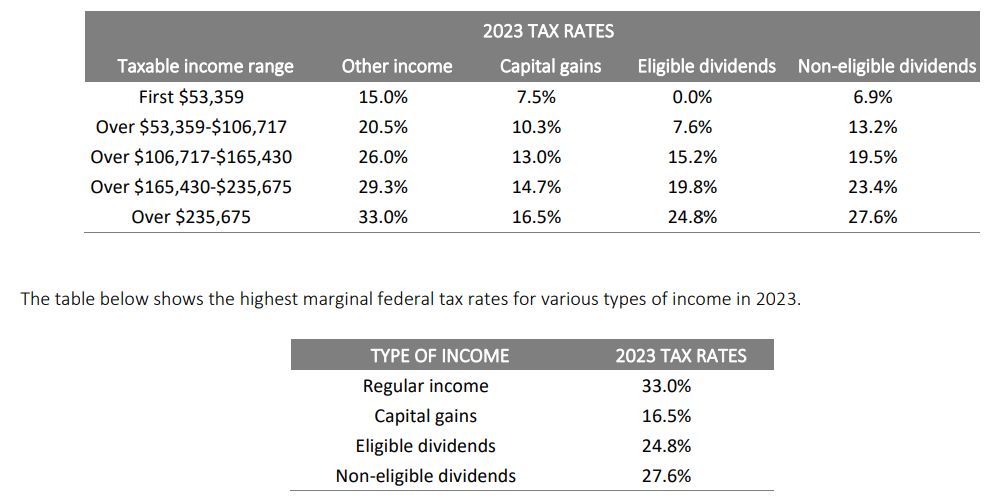

Personal income tax rates and tax brackets

There were no proposed changes to personal income tax rates. Tax brackets and other amounts have been indexed by 6.3% to recognize the impact of inflation. The table below shows federal personal income tax rates and brackets for 2023.

The Grocery Rebate

The Goods and Services Tax Credit (GSTC) helps to offset the impact of the GST on low- and modest-income individuals and families. The GSTC is non-taxable, income-tested, and indexed to inflation.

Budget 2023 proposes to introduce an increase to the maximum GSTC amount for January 2023 that would be known as the Grocery Rebate. Eligible individuals would receive an additional GSTC amount equivalent to twice the amount received for January. The Grocery Rebate would be paid as soon as possible following the passage of legislation, through the GSTC system.

The maximum amount under the Grocery Rebate would be:

- $153 per adult;

- $81 per child; and

- $81 for the single supplement.

To legislate this change, the maximum GSTC amount for January 2023 would be replaced with an amount that is triple the maximum for that month under the current rules. For this January 2023 replacement payment only, the phase-in and phase-out rates would be tripled to 6% from 2% and to 15% from 5%, respectively. This ensures that the Grocery Rebate would be fully phased in and phased out at the same income levels as under the current GSTC rules for the 2022/23 benefit year. There would be no change to the income thresholds at which the single supplement phases in and GSTC entitlement phases out.

Registered Education Savings Plans

When a Registered Education Savings Plan (RESP) beneficiary is enrolled in an eligible post-secondary program, government grants and investment income can be withdrawn from the plan as Educational Assistance Payments (EAPs) in order to assist with post-secondary education-related expenses. EAPs are taxable income for the RESP beneficiary.

The Income Tax Act requires that RESPs place limits on the amount of EAPs that can be withdrawn. For beneficiaries enrolled full-time (i.e., in a program of at least three consecutive weeks’ duration requiring at least 10 hours per week of courses or work in the program), the limit is $5,000 in respect of the first 13 consecutive weeks of enrollment in a 12-month period. For beneficiaries enrolled part-time (i.e., in a program of at least three consecutive weeks’ duration requiring at least 12 hours per month of courses in the program), the limit is $2,500 per 13-week period.

Budget 2023 proposes to amend the Income Tax Act such that the terms of an RESP may permit EAP withdrawals of up to $8,000 in respect of the first 13 consecutive weeks of enrollment for beneficiaries enrolled in full-time programs, and up to $4,000 per 13-week period for beneficiaries enrolled in part-time programs.

These changes would come into force on Budget Day. RESP promoters may need to amend the terms of existing plans in order to apply the new EAP withdrawal limits. Individuals who withdrew EAPs prior to Budget Day may be able to withdraw an additional EAP amount, subject to the new limits and the terms of the plan. The Income Tax Act allows for EAPs to be withdrawn up to six months after a beneficiary ceases to be enrolled in an eligible program.

Allowing divorced or separated parents to open joint RESPs

At present, only spouses or common-law partners can jointly enter into an agreement with an RESP promoter to open an RESP. Parents who opened a joint RESP prior to their divorce or separation can maintain this plan afterwards but are unable to open a new joint RESP with a different promoter. Budget 2023 proposes to enable divorced or separated parents to open joint RESPs for one or more of their children, or to move an existing joint RESP to another promoter. This change would come into force on Budget Day.

Registered Disability Savings Plans

Registered Disability Savings Plans (RDSPs) are designed to support the long-term financial security of a beneficiary who is eligible for the disability tax credit. Where the contractual competence of an individual who is 18 years of age or older is in doubt, the RDSP plan holder must be that individual’s guardian or legal representative as recognized under provincial or territorial law.

However, establishing a legal representative can be a lengthy and expensive process that can have significant repercussions for individuals. Some provinces and territories have introduced measures that provide sufficient flexibility to address this concern.

A temporary measure, which is legislated to expire on December 31, 2023, allows a qualifying family member, who is a parent, spouse or common-law partner, to open an RDSP and be the plan holder for an adult whose capacity to enter into an RDSP

contract is in doubt, and who does not have a legal representative. Budget 2023 proposes to extend the qualifying family member measure by three years, to December 31, 2026. A qualifying family member who becomes a plan holder before the end of 2026 could remain the plan holder after 2026.

Siblings as qualifying family members

To increase access to RDSPs, Budget 2023 also proposes to broaden the definition of ‘qualifying family member’ to include a brother or sister of the beneficiary who is 18 years of age or older. This will enable a sibling to establish an RDSP for an adult with mental disabilities whose ability to enter into an RDSP contract is in doubt and who does not have a legal representative.

This proposed expansion of the existing qualifying family member definition would apply as of royal assent of the enabling legislation and be in effect until December 31, 2026. A sibling who becomes a qualifying family member and plan holder before

the end of 2026 could remain the plan holder after 2026.

Alternative Minimum Tax for High-Income Individuals

The Alternative Minimum Tax (AMT) is a parallel tax calculation that allows fewer deductions, exemptions, and tax credits than under the ordinary income tax rules, and that currently applies a flat 15% tax rate with a standard $40,000 exemption amount instead of the usual progressive rate structure. The taxpayer pays the AMT or regular tax, whichever is highest. Additional tax paid as a result of the AMT can generally be carried forward for seven years and can be credited against regular tax to the extent regular tax exceeds AMT in those years. The AMT does not apply in the year of death.

To better target the AMT to high-income individuals, Budget 2023 proposes several changes to its calculation. Key design features of the new AMT regime are described in detail below. Additional details will be released later this year.

Broadening the AMT base

A number of changes are proposed to broaden the AMT base by further limiting tax preferences (i.e., exemptions, deductions, and credits).

Capital gains and stock options

The government proposes to increase the AMT capital gains inclusion rate from 80% to 100%. Capital loss carry forwards and allowable business investment losses would apply at a 50% rate. It is also proposed that 100% of the benefit associated with

employee stock options would be included in the AMT base.

Lifetime capital gains exemption

Under current rules, 30% of capital gains eligible for the lifetime capital gains exemption are included in the AMT base. The government proposes to maintain this treatment.

Donations of publicly listed securities

The government proposes to include 30% of capital gains on donations of publicly listed securities in the AMT base, mirroring the AMT treatment of capital gains eligible for the lifetime capital gains exemption. The 30% inclusion would also apply to the

full benefit associated with employee stock options to the extent that a deduction is available because the underlying securities are publicly listed securities that have been donated.

Deductions and expenses

Under the new rules, the AMT base would be broadened by disallowing 50% of the following deductions:

- employment expenses, other than those to earn commission income;

- deductions for Canada Pension Plan, Quebec Pension Plan, and Provincial Parental Insurance Plan contributions;

- moving expenses;

- childcare expenses;

- disability supports deduction;

- deduction for workers’ compensation payments;

- deduction for social assistance payments;

- deduction for Guaranteed Income Supplement and Allowance payments;

- Canadian armed forces personnel and police deduction;

- interest and carrying charges incurred to earn income from property;

- deduction for limited partnership losses of other years;

- non-capital loss carryovers; and

- Northern residents deductions.

Expenses associated with film property, rental property, resource property, and tax shelters that are limited under the existing AMT rules would continue to be limited in the same manner.

Non-refundable credits

Currently, most non-refundable tax credits can be credited against the AMT. The government proposes that only 50% of nonrefundable tax credits would be allowed to reduce the AMT, subject to the following exceptions:

- The Special Foreign Tax Credit would continue to be allowed in full and would be based on the new AMT tax rate.

- The proposed AMT would continue to use the cash (i.e., not grossed-up) value of dividends and fully disallow the Dividend Tax Credit.

- Some non-refundable credits that are currently disallowed would continue to be disallowed in full: the Political Contribution Tax Credit, the Labour Sponsored Venture Capital Corporations Credit, and the non-refundable portion of investment tax credits.

Raising the AMT exemption

The exemption amount is a deduction available to all individuals (excluding trusts, other than graduated rate estates) that is intended to protect lower- and middle-income individuals from the AMT. The government proposes to increase the exemption from $40,000 to the start of the fourth federal tax bracket. Based on expected indexation for the 2024 taxation year, this would be approximately $173,000. The exemption amount would be indexed annually to inflation.

Increasing the AMT rate

The government proposes to increase the AMT rate from 15% to 20.5%, corresponding to the rates applicable to the first and second federal income tax brackets, respectively.

Carry forward period

The length of the carry forward would be maintained at seven years.

Treatment of trusts

Trusts that are currently exempt from the AMT would continue to be exempt. The government will continue to examine whether

additional types of trusts should be exempt from the AMT.

Coming into force

The proposed changes would come into force for taxation years that begin after 2023.

We can help

We can help you assess the impact of these proposals on your portfolios.

Be sure to check out our articles on corporate tax matters and sales & excise tax matters.

We work with business professionals, executives, and families to grow and protect their wealth using our Wealth Plan formula. To discuss our approach and if it is the right fit for you, we invite you to schedule a no-obligation discovery consultation.

Disclaimer

This communication is published by CI Assante Wealth Management (“Assante”) as a general source of information only. It should not be construed as providing specific tax, accounting, legal or investment advice, and should not be relied upon as such. Professional advisors should be consulted prior to acting on any information provided herein. Neither Assante nor any of its affiliates, or their respective officers, directors, employees or advisors will be responsible in any manner for direct, indirect, special or consequential damages or losses, howsoever caused, arising out of the use of this communication. Facts and data provided herein are believed to be reliable as at the date of publication, however Assante cannot guarantee that they are accurate or complete or that they will remain current at all times. CI Assante Wealth Management is a registered business name of Assante Wealth Management (Canada) Ltd. CI Assante Private Wealth is a division of CI Private Counsel LP. © 2023 CI Assante Wealth Management. All rights reserved.