February 2023 Portfolio Construction

By Alfred Lam, CFA, Senior Vice-President, and Head of Multi-Assets, CI Global Asset Management.

A Smooth Start (for now)

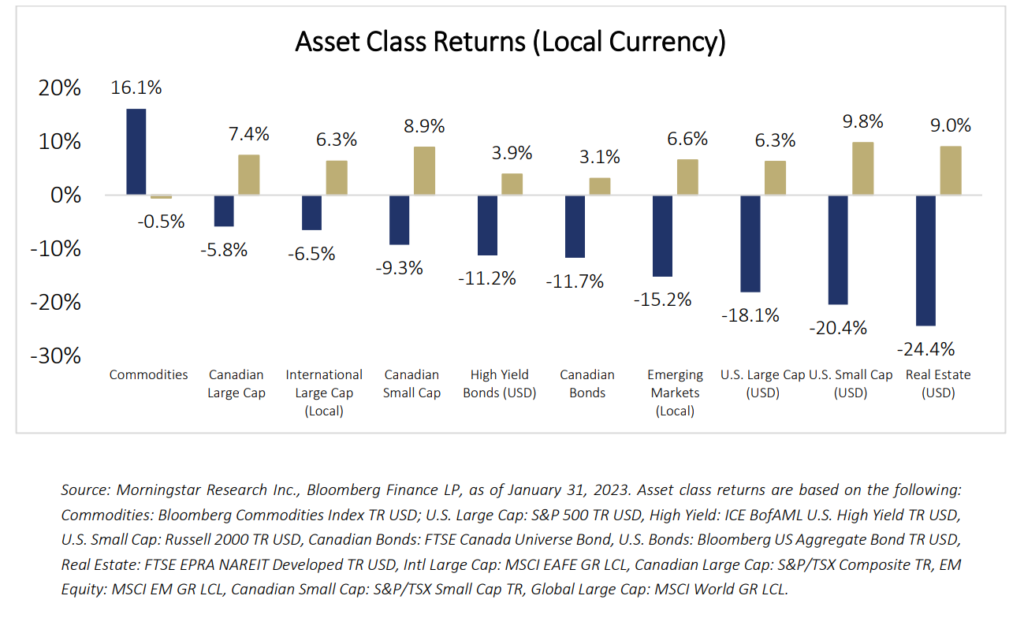

Investors’ appetites have increased as we entered 2023. Generally, at asset class level, the larger the loss in 2022, the larger the gain (recovery) in 2023, though this is only the data for January (see chart below). We recognize investors are feeling reassured by progress on several issues: First, China exited their zero-COVID restrictive policy and is now fully reopened. Second, inflation

is cooling and there is confidence it will gradually decline to 3% in 2023. As a result, central banks will at least pause hiking rates in the coming months. Third, the Russia/Ukraine situation, while unresolved, is also not getting worse. Last but not least, Europe was able to maintain healthy natural gas inventory as the winter was warmer than usual, hence lower drawdown.

The gains have been impressive considering the very short time frame. Our portfolios have had a similar experience: “recovery ratio” and performance were enhanced due to stronger performance in equity driven by an overweight allocation to China, small caps, and real estate. Hedging a portion of our USD exposure also added value. On the other hand, an overweight energy position was a detracting factor in January.

We do not expect the next 11 months to be as smooth as January. Some of the good news has been baked into asset prices, as we’ve seen from recent market rallies. We have made some adjustments including raising cash (which now has a yield of 4%), trimming bonds, and reducing Chinese and U.S. equity exposure. Cash will be re-deployed when opportunities arise, but must at least beat the 4% return hurdle. This means we will probably return to purchasing equity before bonds, bearing in mind a 10-year Canadian bond only yields 3.1% today (Feb 9, 2023).

Disclaimer

This document is intended solely for information purposes. It is not a sales prospectus, nor should it be construed as an offer or an invitation to take part in an offer. This document may contain forward-looking statements about one or more funds, future performance, strategies or prospects, and possible future fund action. These statements reflect what CI Assante Wealth Management (“Assante”) and the authors believe and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments. The author and/or a member of their immediate family may hold specific holdings/securities discussed in this document. Any opinion or information provided are solely those of the author and does not constitute investment advice or an endorsement or recommendation of any entity or security discussed or provided by CI Global Asset Management. Neither Assante nor its affiliates or their respective officers, directors, employees or advisors are responsible in any way for damages or losses of any kind whatsoever in respect of the use of this document. Assante Private Portfolios are available exclusively through Assante Capital Management Ltd. and Assante Financial Management Ltd., dealer subsidiaries of CI Assante Wealth Management. Assante Private Portfolios is a program that provides strategic asset allocation across a series of portfolios comprised of Assante Private Pools and CI mutual funds and is managed by CI Global Asset Management. Assante Private Portfolios is not a mutual fund. CI Global Asset Management provides portfolio management services as a registered adviser under applicable securities legislation. Commissions, trailing commissions, management fees and expenses may all be associated with investments in mutual funds, pool funds, and the use of Assante Private Portfolios. Mutual funds and pool funds are not guaranteed, their values change frequently, and past performance may not be repeated. Please read the fund prospectus and consult your advisor before investing. Assante Capital Management Ltd. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. Assante Financial Management Ltd. is a member of the Mutual Fund Dealers Association of Canada and MFDA Investor Protection Corporation (excluding Quebec). CI Assante Wealth Management is a registered business name of Assante Wealth Management (Canada) Ltd. CI GAM | Multi-Asset Management is a division of CI Global Asset Management. CI Global Asset Management is a registered business name of CI Investments Inc. This document may not be reproduced, in whole or in part, in any manner whatsoever, without the prior written permission of Assante. © 2023 CI Assante Wealth Management. All rights reserved.