February 2022 Market Commentary

This month, we look at key economic indicators and again, what our expectations are for inflation and what it means for portfolio positioning.

Canadian labour market extends gains

Updated figures from Statistics Canada reflected a 54,700 job gain in December 2021, following a 153,700 advance in November. By September 2021, the Canadian job market officially regained the pandemic-induced job losses. Steady job growth since then has seen the unemployment rate, which peaked at 13.1% in April 2020, decline to 5.9% in December, its lowest rate since February 2020 (5.7%).

Not surprisingly, accommodations and food services workers were hit the hardest by COVID-19. From the pre-pandemic peak (May 2018), employment in this sector had plunged 51.4% by April 2020. Conversely, employment in public administration peaked during the 2019 federal election and then dipped a modest 6.6% by May 2020. By April 2021, overall government employment reached a new record high and has grown steadily since.

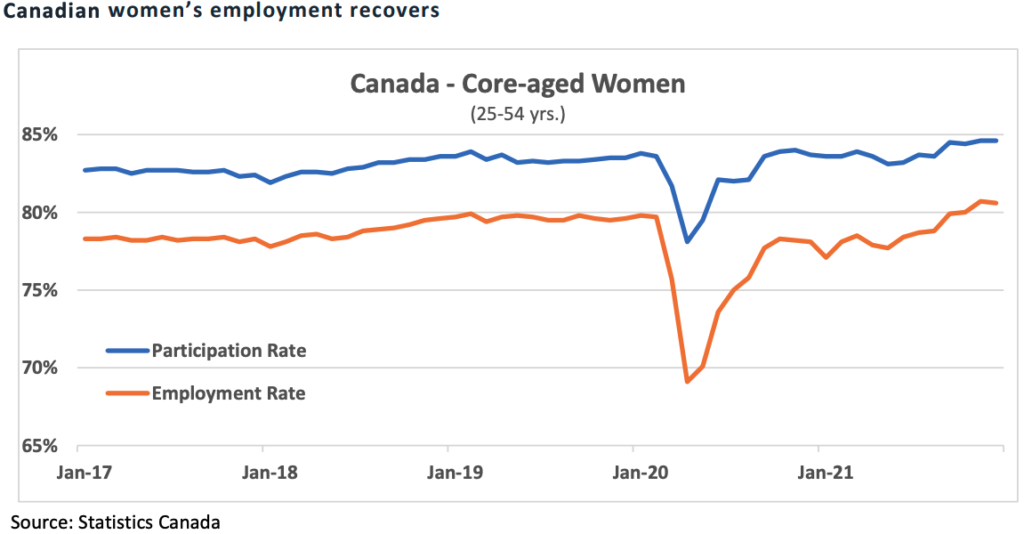

During the early days of the pandemic, there were also concerns over job losses, specifically for women. This came to be referred to as a “she-cession.” Statistics Canada reported that the employment rate (the percentage of employed individuals in the workforce) for “core-aged women” (aged 25 to 54) fell from 79.7% in February 2020 to just 69.1% in April 2020. However, the November data revealed that the employment rate had surged to 80.7%, the highest figure recorded since comparable data became available in 1976 (an 80.6% figure was recorded in December 2021). Similarly, the participation rate for this cohort established a new all-time high of 84.6% in November (also 84.6% in December). Further broad-based growth in Canada’s labour market is expected once social restrictions are reduced once more.

U.S. consumer spending surges in 2021

The latest data from the U.S. Census Bureau revealed a surprise 1.9% (seasonally-adjusted) decline in retail and food services sales during the month of December. Nevertheless, despite the monthly reversal, the final quarter of 2021 saw sales rise by an annualized 8.7%. For the year, retail spending grew 19.3%, the strongest single-year growth rate since consistent data was first recorded in 1992. The annual advance comes on the heels of a far more modest 0.5% gain in 2020. The experience was quite different during the economic recession that accompanied the financial crisis. Retail and food service sales declined in consecutive years, falling 1.1% in 2008 and 7.4% in 2009. Government support during the pandemic clearly bolstered consumer spending. Not surprisingly, the 2021 surge in demand has been accompanied by a similar rise in inflationary pressures.

Japan’s trade hits record high despite Omicron wave

Japanese exports and imports hit record values in December. The most recent figures from the Ministry of Finance revealed that yen-denominated outbound shipments rose 17.5% in December, capping off a year of robust increases, with exports posting double digit advances in nine of the last 12 months. The gain largely reflected soaring commodity prices, which inflated the value of goods sold overseas. Imports surged by over 40% for a second consecutive month, with the values of crude oil, liquefied natural gas and coal all having more than doubled from a year earlier.

However, in volume terms, exports were up just 2%, while imports rose only 1% as higher material costs and a weaker yen dampened inbound shipments. The resilience in exports adds to signs showing that the economy likely rebounded in the fourth quarter of 2021, before the Omicron variant swept across the globe. Annual figures for 2021 showed that Japan posted a trade deficit of ¥1,472.2 billion – its first in two years – with exports and imports advancing 21.5% and 24.3%, respectively.

Longer view

Interest rates are at their bottom with the next move likely to be higher, and some investors are hung up on when this will take place. Judging by economic growth, unemployment rates and inflation, we believe the economies are ready for higher rates. So, anytime is fine as long as it is gradual and does not present a shock. We are confident central banks will be managing the hike cycle carefully. How much higher? We suspect the terminal rate is around 2%. A terminal rate is the maximum lending rate of a central bank at the end of a hike cycle. Two percent is substantially lower than normal; but it is important to recognize that we are in a “new normal” where the debt outstanding is significantly bigger, and lower is actually reasonable.

Economies typically start to slow as interest rates peak. We expect central banks to take their time to hike rates to 2%, in possibly two if not three years. Given that 2% is a low hurdle compared to corporate earnings growth, equity should continue to perform as it is obvious that certain sectors will fare better. Long-dated bonds, both 10-year Canada government bonds and U.S. Treasury bonds, are currently yielding below the terminal rate and unlikely to improve anytime soon.

As always, we are here to support you in achieving your financial goals. Please do not hesitate to contact us.

IMPORTANT DISCLOSURES

The information contained herein consists of general economic information and/or information as to the historical performance of securities, is provided solely for informational and educational purposes and is not to be construed as advice in respect of securities or as to the investing in or the buying or selling of securities, whether expressed or implied. These statements reflect what CI Assante Wealth Management (“Assante”), and the authors believe and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments. Neither Assante nor its affiliates, or their respective officers, directors, employees or advisors are responsible in any way for any damages or losses of any kind whatsoever in respect of the use of this document or the material herein. CI Assante Wealth Management is a registered business name of Assante Wealth Management (Canada) Ltd. CI GAM | Multi-Asset Management is a division of CI Global Asset Management. CI Global Asset Management is a registered business name of CI Investments Inc. This document may not be reproduced, in whole or in part, in any manner whatsoever, without the prior written permission of Assante.