Dynamic Hedging – Making Your Dollar Go Further

As part of their June Commentary, Alfred Lam, Senior Vice-President and Chief Investment Officer and Marchello Holditch, Vice-President and Portfolio Manager, CI Multi-Asset Management, unveil their new dynamic hedging model designed to minimize the impact currency swings can have on returns, while maximizing diversification with the least cost and complexity.

Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer

Marchello Holditch, CFA, Vice-President and Portfolio Manager

CI Multi-Asset Management

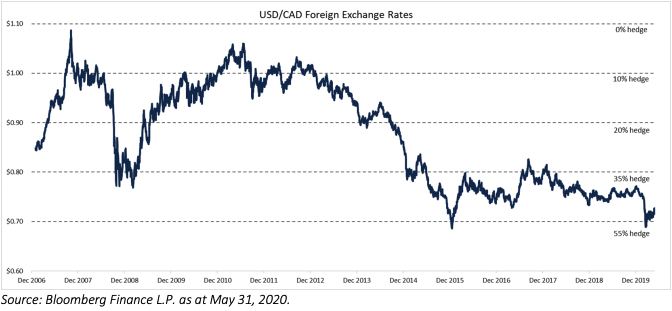

We are in an investment environment with greater volatility, particularly in currency movements, which have short-term impacts on asset class returns. These movements can be significant, causing the positive returns of foreign securities in local currency to become negative when converted to Canadian dollars. This year alone the value of the Canadian currency in U.S. dollars began at 77 cents (as at January 6, 2020) and dropped to as low as 69 cents (March 19), before recovering to 75 cents (June 10).

To mitigate the impact of these swings, we employ a currency hedging strategy across our portfolios. Our currency hedging ratio varies depending on how far the Canadian dollar is trading from the mean (average) as we believe currencies tend to revert to the mean over the long term. Therefore, as the Canadian dollar declines, the hedge will increase, and as it strengthens, the hedge will decrease. As currency values shift, we adjust our hedging strategy. For example, our hedge ratio was 50% at the end of January. We then increased it to 75% in March to mitigate further currency volatility, before reducing it back to 50% in early June. Initially, this hedging strategy detracted value as the Canadian dollar fell, then added value as the Canadian dollar rebounded and is now very close to neutral year-to-date.

Our U.S. dollar currency hedging strategy continues to provide many diversification benefits while reducing the effects of currency movements on individual portfolios. However, we recently introduced a new dynamic hedging model that is better suited for today’s environment of volatile stock markets and currencies. The new model will still minimize short-term currency effects while also reducing the costs and impacts when volatility does spike.

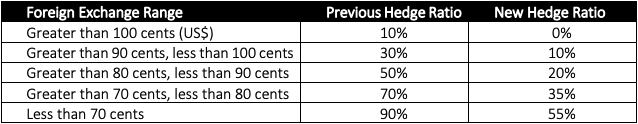

The table below shows the hedge ratios CI Multi-Asset Management will use for a range of Canadian dollar values. These new hedge ratios serve as guidelines and we may increase or decrease the ratio on a tactical basis from time-to-time. With the Canadian dollar now trading near 74 cents (as at June 15, 2020), we recently took the opportunity to move to the new model and are now hedged at approximately 35%.

We prefer a dynamic process over not hedging or hedging 100%. Our strategy is designed to minimize the impact on portfolio returns while maximizing diversification with the least cost and complexity. When investing in foreign asset classes, the timing of the investment can significantly impact future performance depending on the exchange rate. For example, when the U.S. dollar is unusually expensive, it would make sense to invest in a fully-hedged pool. Conversely, when the U.S. dollar is unusually inexpensive, it would make sense to invest in an unhedged pool. Our dynamic currency hedging model allows the investor to gain exposure to the foreign asset class with less impact on returns when measured in Canadian dollars. This is because, regardless of the currency rate at the time one invests, the currency hedge adjusts for the current level of the exchange rate.

We emphasize that this is not a tactical hedge strategy designed to predict and profit from currency movements. The dynamic currency hedging strategy is designed to achieve a better long-term average return for investors over their investment time horizon.

Combined top 15 equity holdings as of May 31, 2020 of the Evolution 40i60e Standard portfolio with Alpha-style exposure:

- Microsoft Corp.

- Visa Inc.

- Amazon.com, Inc.

- Apple Inc.

- Dollarama Inc.

- Prologis Inc.

- Alphabet Inc.

- Fortis Inc.

- Brookfield Asset Management Inc.

- Franco Nevada Corp.

- UnitedHealth Group Inc.

- Anthem Inc.

- Tencent Holdings Ltd.

- TMX Group Ltd.

- Constellation Software Inc.

Source: Bloomberg Finance L.P. and CI Multi-Asset Management as at June 17, 2020.