The Cost of Waiting to Invest

In the realm of financial planning, time is not just a factor—it’s a pivotal player. Like most Canadians, you’ve made astute financial decisions and made a commitment to your future financial goals. Yet, in this journey, there’s a silent tide that often goes unnoticed: the impact of waiting to invest.

This article peels back the layers of this often-overlooked aspect of financial planning. We’re not just talking about investments in the traditional sense; we’re exploring the profound effects of timing. It’s a nuanced conversation, one that extends beyond the mere act of placing your funds into the market. It’s about understanding the undercurrents that can either propel you forward or hold you back.

Consider this as a navigational chart, guiding you through the complexities of investment timing. Here, we’ll discuss the power of time, demystify the myths of market timing, and talk about the real consequences of delay.

The Power of Time: Unleashing the Potential

Compounding: The Eighth Wonder of the World

One of the most compelling forces in the investment world is compounding. Often hailed as the eighth wonder of the world, its power lies in its simplicity and impact. Compounding is the process where your investment earnings are reinvested to generate their own earnings. Over time, this reinvestment strategy turns a steady trickle of returns into a surging river of financial growth.

To truly appreciate compounding, one must recognize its dependence on time. The longer your investment horizon, the greater the potential for compounding to work its magic. It’s a game of patience and foresight, where the early bird doesn’t just get the worm but cultivates an entire garden.

Hypothetical Scenario: The $100,000 Question

Let’s illustrate this with a scenario: imagine you have $100,000 for investment. Opting for a conservative stock market venture, you anticipate an average annual return of 8%. If you invest today, in 10 years, you could be looking at an investment worth approximately $215,892. But what if you hesitate and wait for five years before diving in? That same investment could potentially only grow to about $147,010 over 10 years. The cost of waiting? $68,882.

This hypothetical example is more than a numbers game. It’s a real representation of the opportunity cost that comes with delayed investing. The longer you wait, the more you’re sidelining your financial potential. Hesitation in investing can be costly, and not just in terms of dollars and cents. It’s the loss of time—a resource that, once gone, cannot be replenished. The impact of this delay manifests not just in reduced returns but in lost opportunities for your money to work for you.

Understanding the high price of hesitation is critical in a financial landscape where timing can make or break your long-term goals. It’s a call to action, a prompt to shift from a passive stance to an active approach in managing your finances.

Seizing the Opportunities: Time in the Market

Market Timing vs. Time in Market

In the pursuit of investment growth, a common dilemma often surfaces: should you attempt to time the market or prioritize time in the market? It’s a question that has been asked by many over the years, by both financial professionals and individual investors alike.

Market timing – the strategy of making buying or selling decisions of financial assets by attempting to predict future market price movements – is as alluring as it is risky. The reality of the situation is that even the most seasoned investors find it challenging to predict market fluctuations accurately and consistently.

On the other hand, time in the market emphasizes a long-term approach. It’s about maintaining a steady course through market ups and downs, understanding that while the financial markets may fluctuate, they have historically trended upwards over the long term. This approach banks on the resilience and growth of the markets over time, rather than the precariousness of short-term predictions.

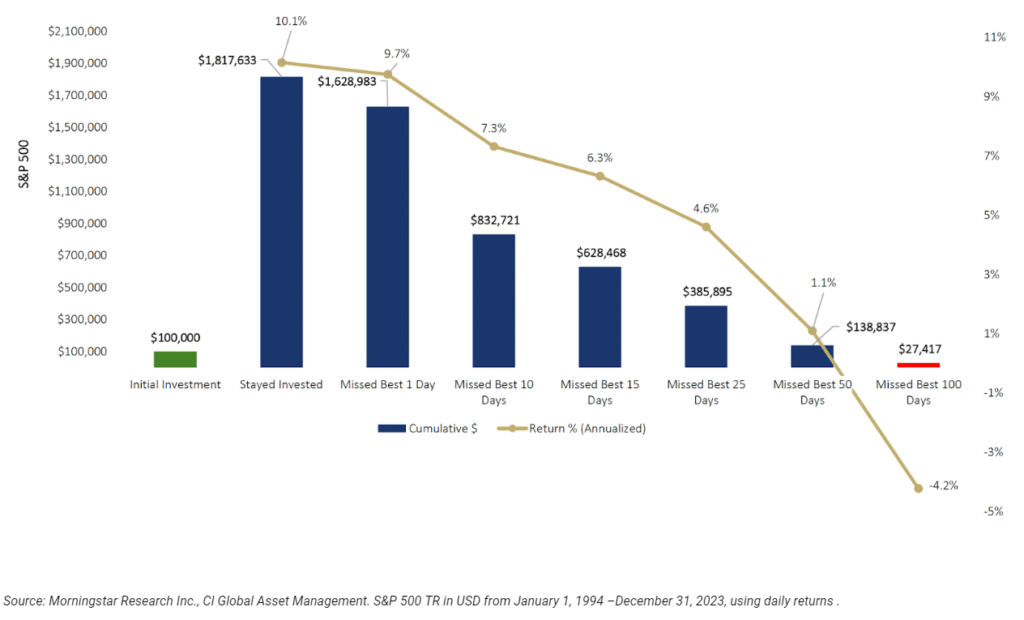

Real-Life Example: Value of $100,000 invested in S&P 500 during prior 30 years

Consider a $100,000 investment in the S&P 500 during the prior 30 years. If you stayed invested in the S&P 500 Composite fully for 30 years you would be far better off, an investment of $100,000 would have grown to $1,817,633. If you tried to time the market and missed 10 of the best trading days your investment would have grown to only $832,721. Missing out on $984,913 of growth!

You don’t want to panic and sell at lows as the best positive days can compound return and make a large difference in the value of your portfolio,

To put this into perspective, let’s consider a real-life example. Imagine you have $50,000 ready for investment. If you decide to invest this sum in a diversified portfolio today and achieve an average annual return of 6%, in 20 years, your investment would potentially grow to approximately $193,567. However, if you decide to wait and invest after five years, you might only see this grow to about $140,255 over the same 20-year period. The difference of $53,312 is not just a loss in potential earnings but also a stark reminder of the power of time in the market.

Inflation: The Silent Wealth Eroder

A critical, often overlooked aspect of delayed investing is inflation. Inflation gradually reduces the purchasing power of money, which can erode the value of your savings if they are not actively growing. By waiting to invest, you’re not only missing out on potential gains but also allowing inflation to diminish the value of your capital. Investing can serve as a shield against this erosion, offering growth that can potentially outpace inflation and maintain, if not enhance, the purchasing power of your savings.

Seize the Day: Take Action Now

Recognizing the cost of waiting, the question then becomes, how do you start? First and foremost, start today. The best time to plant a tree was 20 years ago; the second best time is now. If you’re new to investing or have been hesitant, begin with a well-thought-out plan. This might involve setting clear financial goals, understanding your risk tolerance, and determining an appropriate asset allocation.

Consistency is key. Regular, disciplined investing, perhaps through an automatic investment plan, can help you take advantage of dollar-cost averaging, reducing the impact of market volatility. This approach involves investing a fixed amount of money at regular intervals, regardless of the market conditions, which can potentially lower the average cost of your investments over time.

Diversification is another crucial element. By spreading your investments across various asset classes, you can mitigate risk and increase the likelihood of capturing growth opportunities in different market conditions. Additionally, regular reviews of your investment strategy are vital to ensure it remains aligned with your changing financial circumstances and goals.

In the next section, we’ll introduce you to Ferguson Financial Planning, your partner in navigating the investment landscape, and discuss how our Wealth Plan formula can be tailored to your unique financial situation and aspirations. Remember, the journey to financial success is not a sprint; it’s a marathon. And with the right approach, you can make the most of every step along the way.

In Summary

In wrapping up our discussion, it’s clear that the cost of waiting to invest can have significant implications for your financial future. The journey to financial growth is punctuated by timely decisions, strategic planning, and an understanding of the market dynamics. We have a helpful calculator that you can use to see what the cost of waiting may look like for your personal situation. You can access our Cost of Waiting to Invest calculator here.

We are here to help you meet your investment goals and we welcome your questions. We work with business professionals, executives, and families to grow and protect their wealth using our Wealth Plan formula. To discuss our approach and if it is the right fit for you, we invite you to schedule a no-obligation discovery consultation.