All Your Inflation Questions Answered

You may have been hearing more and more about inflation in the news or on social media recently, but what does it mean? You have probably heard your parents or grandparents say that “back in my day a cup of coffee cost $0.25”. Nowadays most of us are spending at least $2.00 for a cup of coffee. While this is a small and simple example, it does show how the cost of things we buy rises over time.

What is inflation?

Simply put, inflation is the increase in prices over time.

More technically, inflation is the decline of purchasing power of a given currency over time. How much the inflation rate rises is dependent on the increase of an average price of a fixed set of consumer products and services whose price is evaluated on a regular basis, often monthly or annually (often called a “basket of selected goods”).

As the level of prices rise, that means that your dollar doesn’t go as far as it used to, effectively meaning it buys less than it did in the past.

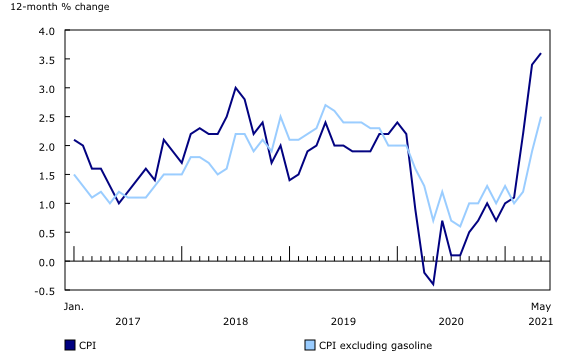

According to Statistics Canada, the average rate of inflation for the last 30 years has been 1.8%. The current trajectory is 3.6%. The figure below shows the inflation rate fluctuations over the past four-and-a-half-years.

Source: Statistics Canada, 12-month change in the Consumer Price Index (CPI) and CPI excluding gasoline.

Why is this happening?

While inflation is a normal part of the business cycle, inflation has been on the rise recently for the following reasons:

- We had a very low starting point – for instance, last year during the pandemic a lot of goods and services had low demand because we had no use for them (think air travel, office attire, party supplies, etc.). This drove the price of these goods down as there was not a lot of demand. With the economy reopening, the demand for these goods has gone up, meaning that their prices have too. When you compare the current price to the low prices from last year, that is going to be a big increase, relatively speaking.

- Government Stimulus – Last year the Canadian government provided a record number of unemployment cheques to folks unable to work through the pandemic. There is more money circulating through the economy which means there is more money to buy goods, ultimately driving up the price of goods, leading (of course) to inflation.

- Bank of Canada – While beyond the scope of this article, it is important to know that the Bank of Canada has the ability to influence short term interest rates, which in turn can impact the amount of money in circulation and the amount of money consumers and investors can easily access.

- We had a very low starting point – for instance, last year during the pandemic a lot of goods and services had low demand because we had no use for them (think air travel, office attire, party supplies, etc.). This drove the price of these goods down as there was not a lot of demand. With the economy reopening, the demand for these goods has gone up, meaning that their prices have too. When you compare the current price to the low prices from last year, that is going to be a big increase, relatively speaking.

The current interest rate set by the Bank of Canada is 0.25%, which is very, very low. This also explains why new mortgage rates or other borrowing rates, like your personal line of credit, may also be low or lower than they have been previously. When the cost to borrow is “cheap”, people tend to borrow more and therefore can spend more, whether it be to buy a new home or another good. The easier it is to buy these items, because the cost to borrow is so low, the more demand there is for these items, driving the price up and voila we have inflation.

Why should I care about it?

Going back to our cup of coffee example, a rising rate of inflation means that next year your $2.00 cup of coffee will cost you $2.07. Not a big deal, but extend this to bigger purchases like a car, tv or vacation and you can see the cost quickly rises. If your income is not growing with at least this rate you will have to either buy less or buy the same, but at the cost of not being able to save as much or through increasing your debt.

What should I do about it?

While you can’t necessarily ask your local barista to reduce coffee prices or ask all Canadian consumers to stop purchasing goods, you can do things to help your dollars stretch further.

- Always have a budget. This will allow you to track your spending to ensure you are ultimately not spending more than you are earning as inflation slowly creeps up

- Don’t leave long term cash in your bank account doing nothing. What I mean by this is if you are saving for a big purchase 3 years from now, or find you are building up cash in your bank account with no set goal in mind, leaving this cash in your bank account is equivalent to leaving cash under your mattress and letting the bed bugs eat it. Every year the value of your dollar is less than it was the year before. Therefore the $1 in your bank today, will only be worth $0.97 next year due to inflation.

- Always have a budget. This will allow you to track your spending to ensure you are ultimately not spending more than you are earning as inflation slowly creeps up

At the very least I recommend a low- risk savings vehicle that will allow you to earn a rate of return that at least keeps up with inflation. This way you know the buying power of your $1 will remain unchanged year over year.

What does this mean for my investments?

Generally speaking, bond prices tend to move in the opposite direction as inflation. When inflation rises, bond prices fall. While bonds do provide protection in a diversified portfolio when the market dips, longer term investors may benefit from strategically reducing their bond exposure in the short term. On the other hand, equity investments (stocks, for example), tend to protect against inflation and even rise during inflationary times.

Ultimately, inflation is a normal part of the market cycle and is not cause for immediate concern. However, over the long term, inflation does impact our ability to purchase goods at the same cost we did the year prior. Having a diversified portfolio that strategically allocates the amount invested in bonds and equities based on where we are in the market cycle with inflation will help keep your dollars from becoming less and less valuable.

We would be pleased to meet with you to discuss and review your current portfolio, and help diversify your portfolio to manage against inflation in the future. Please contact us or schedule a consultation at your convenience.