How to properly plan an FHSA

Saving money is a vital part of financial planning, and finding the right savings vehicle is crucial in achieving your financial goals. Designed to help the younger generation save for their first home, the First Home Savings Account (FHSA) offers several advantages. But it’s important to recognize whether opening one right away, or delaying a little, is the right decision.

In this article, we will explore the benefits and considerations surrounding FHSA to help clients make an informed choice.

Understanding FHSA

The First Home Savings Account is a government initiative aimed at assisting individuals in saving for their first home.

The account is treated as a specialized savings account with attractive tax benefits. Contributions made to an FHSA are tax-deductible, and the interest, dividends, and growth earned within the account is also tax-free. The account operates separately from regular savings accounts, ensuring that the money remains untouched until the goal of homeownership is achieved. This can help children avoid the temptation to dip into their savings for other purposes.

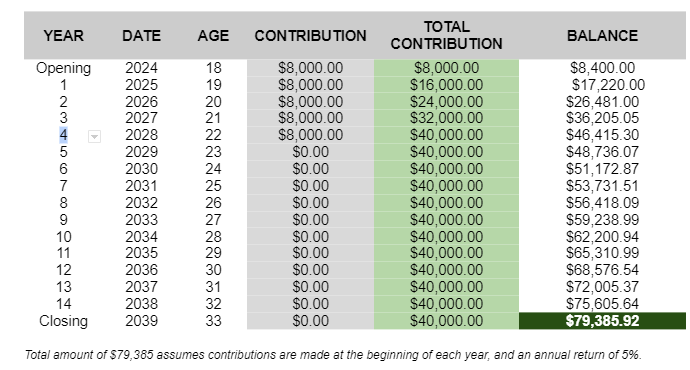

Clients are often eager to set up the FHSA for their child, once they are 18, to benefit more from tax-deferred returns. The annual deposit limit is $8,000 a year, with a lifetime limit of $40,000.

Considerations before Opening an FHSA

Clients should evaluate their time horizon before opening an FHSA.

If the goal of purchasing a first home is a long-term plan (e.g., beyond 5-7 years), there may be alternative investment options that offer higher returns. FHSA accounts are most suitable for those who have a relatively shorter timeframe and want to take advantage of the tax benefits.

According to one study in 2020, the average age for buying a first home in Canada is around 36. If an 18-year-old opens an FHSA, as in our example, they will have to purchase a home by the time they’re 33 or close the account.

We can help

We work with business professionals, executives, and families to grow and protect their wealth using our Wealth Plan formula. To discuss our approach and if it is the right fit for you, we invite you to schedule a no-obligation discovery consultation.

In this case, if you have investments in your FHSA at or before the end of your maximum participation period, you will generally be able to transfer the assets directly, on a tax-deferred basis, to your RRSP, which will allow you to eventually use the government’s Home Buyer’s Plan (HBP).

However, the maximum RRSP withdrawal for the purchase of a qualifying property under the HBP is $35,000 (with repayment conditions).

While approximately $44,385 ($79,385 from the FHSA minus $35,000 for the HBP) will remain in the RRSP and continue to grow on a tax-deferred basis, the goal of withdrawing $79,385 tax-free for a down payment on the home will be missed.

If you do not transfer the FHSA amount to your RRSP, the amount withdrawn from the FHSA will be taxable and must be included as income for the year the withdrawal is received. Note that this amount will be subject to withholding tax just like RRSP withdrawals.

For our example, if you withdraw the $79,385 from the FHSA and are not ready to purchase a new home after the 15th year, there would be approximately $47,630 after tax to use toward the eventual purchase of a home. This assumes a 40% tax rate applied to the amount of $79,385 withdrawn from the FHSA.

A Hybrid strategy would be to transfer $35,000 from the FHSA to the RRSP, then withdraw this amount under the HBP in addition to withdrawing the remaining amount of $44,385 from the FHSA ($26,630 after tax). This would allow for a total down payment of $61,630, instead of $47,630 in the above example. Of course, the amount withdrawn under the HBP will have to be repaid to the RRSP.

To summarize, here are the three down payment amounts in our scenario:

Proper FHSA planning (tax-free withdrawal): $79,385

Opening the FHSA too early (taxable withdrawal): $47,630

Opening the FHSA too early and using the hybrid solution: $61,630

As we have seen, there can be significant monetary consequences when an FHSA is opened.

We can help

We are here to help you determine your needs, objectives and savings capacity, as well as the FHSA’s restrictive eligibility criteria so we can figure out the best strategy for you and your personal situation. We work with business professionals, executives, and families to grow and protect their wealth using our Wealth Plan formula. To discuss our approach and if it is the right fit for you, we invite you to schedule a no-obligation discovery consultation.