Five Strategies For Dealing with Difficult Markets

When markets are volatile, it’s natural to be worried about the impact on your portfolio. When you’re worried, you want to take action.

However, it’s important to recognize that sometimes the best course of action may be to do nothing. If you have a sound investment plan, you already may be in the best possible position to weather the market storms. We realize that it can be painful and upsetting to watch the value of your investments experience a significant drop. To assist you in understanding market volatility and in preserving your portfolio, we present five strategies for dealing with difficult markets.

1. Take a long-term view

Any sharp decline in the stock market is often accompanied by dire headlines in the media, often using words like “crisis“ or “meltdown.” Although the news reporting helps to create a climate of urgency and fear, the fact is that volatility is a normal part of investing.

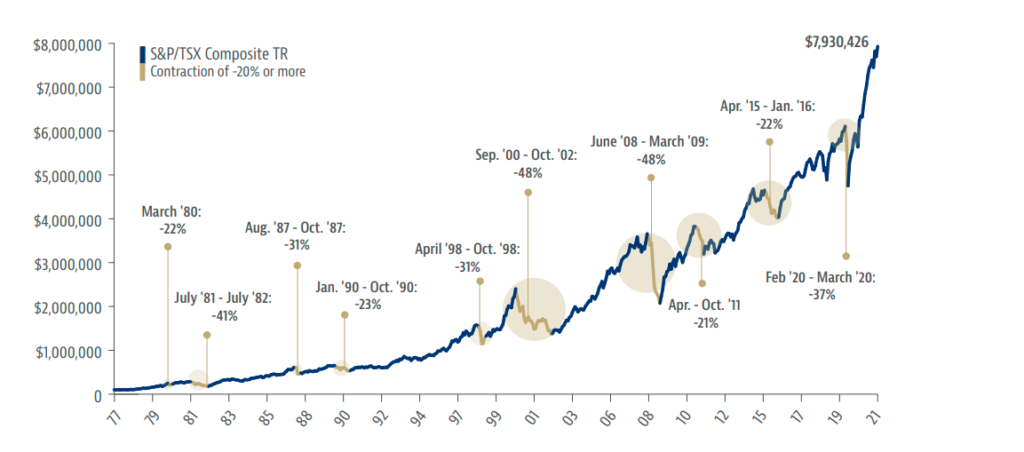

A look at the chart below, which represents the long-term performance of the S&P/TSX Composite Index, shows that fluctuations are simply par for the course. Even significant declines are not unusual. There have been ten declines exceeding 20% in the Canadian market since 1977.

Even though market volatility is not unusual, it can still be unsettling. That’s also why it’s important to remember that market declines have been followed by even greater recoveries. Take another look at the chart. It shows that in every instance, the stock market eventually retraced its losses and went on to post new highs. In other words, the stock market moves in short-term cycles but the long-term trend is up.

In fact, the S&P/TSX Composite Index has posted a very respectable average annual return of 10.2% over the 45 years ending December 31, 2021. But to reach that return, investors had to travel through some peaks and valleys.

One defence against market volatility is to try to put the daily news into a long-term perspective. Despite the crisis reporting, we know that recessions end, businesses continue to operate, and economies and markets recover and grow.

2. Be diversified

Diversification is a key principle in investing. It refers to the practice of spreading your investments among the different asset classes: stocks, bonds, and cash. These broad asset classes can be further subdivided. Stocks, for example, should include Canadian, U.S. and international stocks, as well as large and small company stocks.

Why is diversification important? Each asset class performs differently as market and economic conditions change, and there is no way to predict which one will be the leader. The chart below shows how the returns and the ranking of each asset class have varied dramatically over the past 19 years. You can see how a diversified portfolio will have much more stable returns by reducing its

exposure to any one asset class.

The process of determining a portfolio’s asset mix is called strategic asset allocation. This recognizes that different asset classes have different risk-return profiles. Most portfolios will include some bonds or bond funds, which offer stability but relatively lower long-term returns, and some equities or equity funds, which are more volatile in the short term but have had higher long-term returns.

The goal of strategic asset allocation is to choose a portfolio mix that will maximize returns at a risk

level that is appropriate for you (your “risk tolerance”).

Your risk tolerance reflects factors such as your investment objectives and the period of time over which you are investing, and so on.

If your portfolio is not properly diversified and its asset mix does not reflect your objectives, then it’s time to review your strategic asset allocation. However, if you have already gone through that process, it’s important to stick to your asset allocation even when markets are volatile. Your asset allocation is tailored to your individual situation and should change only when your goals change. Furthermore, strategic asset allocation already considers the historical volatility of the different asset classes. Changing your asset allocation in response to short-term changes in the markets may hinder you in reaching your goals.

3. Resist the temptation of market timing

The ideal strategy for an investor is to sell out of the market before it declines and reinvest just as it begins to recover. Of course, this strategy is nearly impossible to execute in reality. How do you know when to sell and when to buy? There’s an old Wall Street saying: “Nobody rings a bell at the top of the market and nobody rings one at the bottom.”

After a sharp decline in the market, many investors naturally want to sell to avoid the potential for further drops in their equity portfolio. Not only does that lock in your losses, but it also raises the question of when to reinvest. Historically, there have been no indicators that have consistently predicted the direction of the market. Even the economy is not a reliable predictor because the stock market often rebounds months before an economic recovery is evident.

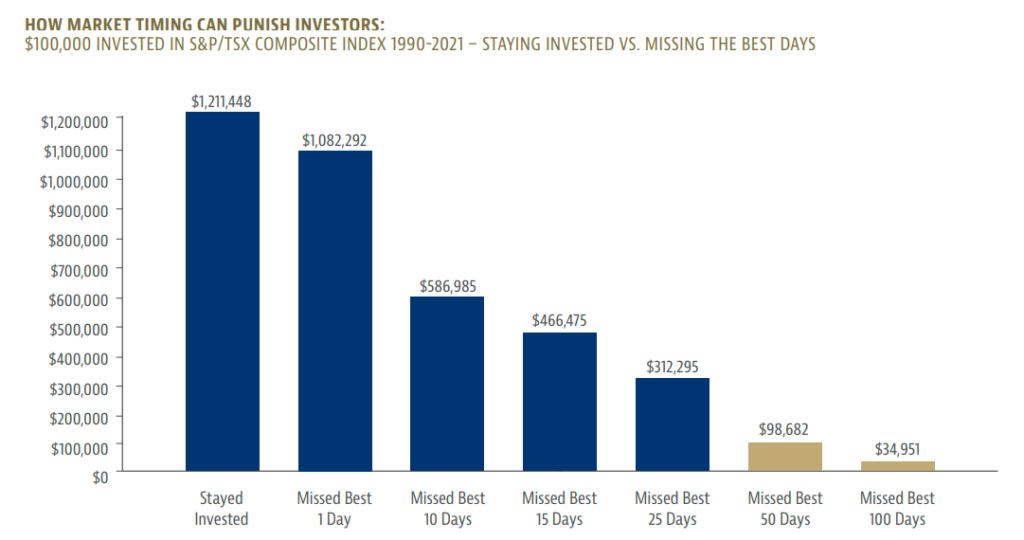

Furthermore, when the market does recover, its gains often come in bursts. Missing those few days or months of strong returns can have a huge impact, as shown in the table. For example, an investor who stayed invested in the Canadian stock market over the entire 32 years ending December 31, 2021 would have had an average annual return of 8.1%. Missing just the 10 best days would have reduced that return to 5.7%, while missing the 25 best days would have resulted in a return of 3.6%. In other words, staying invested can be the best strategy.

4. Take advantage of market volatility

It’s difficult to watch your portfolio and the markets decline in value and think that this is a good thing, but some investors do. Given the stock market’s long-term rising trend, market declines have been an opportunity for long-term investors to buy stocks at lower prices. It’s as if stocks are on sale. This is the thinking behind this statement by Warren Buffet, one of the world’s greatest investors: “Be fearful when others are greedy and be greedy when others are fearful.” Of course, not everyone has billions of dollars in cash like Warren Buffet. There are tried and true strategies that anyone can use to take advantage of market volatility: dollar-cost averaging and rebalancing.DOLLAR-COST AVERAGING

Dollar-cost averaging refers to the practice of investing a fixed amount of money at regular intervals, regardless of market moves. The result is that you buy more units when prices are falling and fewer units when prices are rising. In volatile markets, this practice tends to lower the average cost of your investments, as shown in the simple example in the table. Dollar-cost averaging won’t protect you against a market decline, but it is an easy, disciplined investment strategy proven to pay off over the long term. A study by investment research firm Dalbar, Inc. found that dollar-cost averaging would have produced returns over 20 years that were 40% higher than those experienced by the average investor. (Source: Quantitative Analysis of Investor Behavior, 2007, Dalbar, Inc. www.dalbar.com.)REBALANCING

Rebalancing is the practice of selling asset classes that have performed well and reinvesting in asset classes that have underperformed. It is the process used to maintain one’s asset allocation. Suppose your desired asset allocation is 60% equities and 40% bonds and, after a good year on the stock market, the equity portion of your portfolio has increased to 68%. You would rebalance your portfolio by selling 8% of your equities or equity funds – taking profits – and reinvesting them in bonds or bond funds. This restores your asset allocation to the 60/40 target. (Alternatively, you could direct new money into the bond portion to achieve the same effect.) In general, rebalancing ensures that your portfolio remains true to your risk profile, smooths out your returns, and is a disciplined way to make sure you are “selling high and buying low.”5. Invest with an advisor

Research shows that Canadians who work with a financial advisor accumulate more assets, and the longer they get advice, the more their wealth grows. People who use a financial advisor acquire a greater savings discipline, which plays an important role in growing household wealth over time and in having sufficient funds for retirement. Specifically, the research shows that Canadians who work with a financial advisor for four to six years accumulate 1.58 times more household financial assets than those who go it alone. Households with an advisor for seven to 14 years amass 1.99 times more assets. After 15 years or more, households using an advisor have 2.73 times more assets. (Source: The Gamma Factor and the Value of Financial Advice, by Claude Montmarquette and Nathalie Viennot-Briot, CIRANO, 2016). A financial advisor can assist you in determining your financial goals and developing an investment plan that suits your individual needs, including an appropriate asset allocation. Advisors typically provide services that will:- Clarify your current financial situation, including assets, liabilities, income, expenses, insurance, wills and pensions.

- Help you determine your risk tolerance and financial goals, including living expenses, care for parents and children, and retirement needs.

- Identify problems that may impede the realization of your goals.

- Periodically review your progress and your personal situation, including your objectives and your asset allocation. Advisors have the expertise and experience to guide you through difficult times, so that you’re positioned to benefit from the inevitable recovery