Cryptocurrency: What is it? How can I invest in it?

If you’ve been following the news over the past year, you’ve surely heard about investors getting more heavily into the cryptocurrency space. After all, with such incredible gains over a short period of time, it has gotten people excited about potentially growing their wealth in ways they couldn’t imagine. But of course, with such investments, there are always risks. And for those looking for a runner-up option for their precious metal investments, check out here how to convert ira to gold! To help better understand the risks and rewards, let’s uncover and explore what cryptocurrency and digital coins really are, and how to think about them from an investment perspective when buying altcoin.

What is cryptocurrency?

Cryptocurrency, like fiat currency, is a type of payment that can be exchanged for goods and services. Unlike fiat currency, which can exist in both paper and coin formats, cryptocurrency exists as a digital or virtual currency with no physical form. But what makes cryptocurrency unique is that the coins (or also known as “tokens”) are cryptographically secure, and the security comes from decentralized networks based on blockchain technology you can learn more about with Skrumble experts.

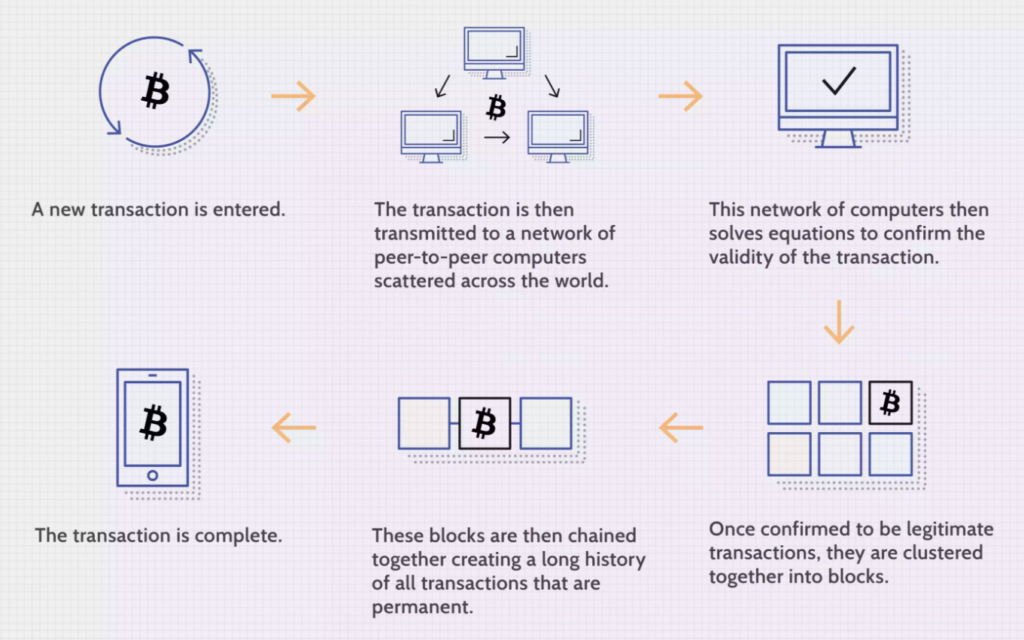

Cryptocurrencies work using ‘blockchain’ technology. Blockchain itself is not cryptocurrency – rather it is the technology that results in the creation of the cryptocurrency. As the name suggests, it is a sequence of blocks that represent a series of transactions that are chained together. This chain of transactions effectively forms the ledger – a digital log of all transactions that have ever been performed. Additionally, this ledger is distributed among all users of the blockchain, so rather than having a single authority with a single log of all transactions, all transactions are chained together in the blockchain and are decentralized across many computers that manage and record transactions. If you’re interested in optimizing your cryptocurrency investment strategy, you might want to explore the benefits of using a cryptocurrency trading bot from immediate connect. You can also learn more about adding prosperity to your crypto investment by visiting https://www.cryptowealthbay.com/precious-metals.

Source: Investopedia

Source: Investopedia

Why is everyone so excited by this?

There are many reasons why cryptocurrency is so popular right now. There are some who view cryptocurrency as the future of the currency, perhaps one day being an alternative form of payment for goods and services. In fact, there are already some notable companies accepting Bitcoin as payment, including Microsoft, Twitch (owned by Amazon), and the Dallas Mavericks NBA team (owned by cryptocurrency enthusiast and entrepreneur Mark Cuban). Because of this, there is heightened interest and demand in acquiring cryptocurrencies (like Bitcoin), which in turn drives the price of the currency even higher.

Some people also view increased security with the underlying technology of cryptocurrencies (the blockchain). The decentralized processing and recording systems of all transactions can be more secure than traditional payment systems. This added security is viewed by some as an advantage of cryptocurrencies.

Which cryptocurrencies should I look for?

As of this writing, there are over 6,000 unique cryptocurrencies (or ‘coins’), all comprising a global market cap of approximately $1.67 trillion. Bitcoin and Ethereum remain the largest cryptocurrencies by market cap, but other coins are gaining popularity, including Dogecoin (more on that below).

Let’s explore what some of these more well-known cryptocurrencies are and what they do:

Bitcoin

Bitcoin is the original cryptocurrency, and contains the highest market cap of all cryptocurrencies, and came about following the financial crisis of 2008-2009. It’s premise was simple – to provide peer-to-peer transactions for the buying and selling of goods/services. Bitcoin effectively allowed one party to pay the other directly without the need to use a trusted intermediate third party like a bank or PayPal to process the transaction. And using the blockchain, it offered security and anonymity in transactions – all transactions on the ledger were encrypted, and the decentralized network of computers would ensure the validity of the transaction. Bitcoin itself has a $750 billion market cap, representing over 40% of the share of all cryptocurrencies.

Ethereum

Ethereum was founded in late 2014, out of the success of Bitcoin and the concept of the blockchain. However, it was designed to be different from Bitcoin by extending beyond financial transactions and into execution of smart contracts. A smart contract is a self-executing contract with the terms between two parties being directly written into lines of code. That code controls the execution of the contract automatically, and all transactions (written to the blockchain) are trackable and irreversible without the need of an intermediary. Some common ways smart contracts are being used include multisignature accounts, encoding financial agreements, and even being used to assist other smart contracts. Ether itself is the cryptocurrency, and as of this writing has a $278 billion market cap, representing a 21% share of all cryptocurrencies.

Dogecoin

This popular meme coin, known for its Shiba Inu dog as its logo, was started originally as a joke in 2013. While started as a joke, it has gained an almost cult-like following, including tweets and pop-culture mentions by Tesla-billionaire Elon Musk. Similar to Bitcoin and Ethereum, Dogecoin runs on blockchain technology. It can be used for payments and purchases, but it is not a very effective store of value, primarily because there is no lifetime cap on the number of Dogecoins that can effectively be created, making it inflationary by design. Through it’s popularity gain on social media platforms, it has risen to the become the 6th largest cryptocurrency by market cap ($26 billion)

How can I acquire coins? And can I invest in cryptocurrency?

Cryptocurrency can be a complement to your existing portfolio – however, acquiring these assets are not as straightforward as purchasing stocks, bonds, mutual funds, or ETFs (until now, more on that below). Some of the major cryptocurrencies (i.e. Bitcoin) can be purchased using Canadian dollars, while other coins require being purchased with an existing cryptocurrency (i.e. exchanging Bitcoin).

There are two ways you can acquire cryptocurrency coins:

- You can mine the coins, or,

- Acquire them by trading fiat currency for the coin on an exchange (similar to how you would purchase stock of a company on a stock market).

Mining is the process by which new cryptocurrency coins are entered into circulation, but is also a critical component in the maintenance and development of the blockchain ledger. Miners are essentially getting paid for their work as auditors. By performing the work of verifying transactions on the blockchain (using their computers, which perform the computations to validate the transaction), they are rewarded coins for their efforts.

To buy cryptocurrency, you will first need to find an exchange where you can exchange your existing currency (Canadian dollars). There are numerous cryptocurrency exchanges, and not every exchange offers the ability to buy/sell any type of cryptocurrency. Upon creating an account at an exchange, you would fund your account and make trades, similar to other self-investing platforms. In order to store/hold your currency, it is recommended to store them on a “digital wallet”. A cryptocurrency wallet is an online app that can hold your currency. Similar to cryptocurrency exchanges, not all wallets can hold all types of cryptocurrency. (Think of this like your bank account – not all banks offer the ability to hold currency in USD, Euros, Yen, etc. Most will require that you exchange to a single currency and then make the deposit). For added protection of your wallet, it is recommended that cryptocurrencies are kept in “cold storage”. With cold storage, your wallet is stored on a platform that is not connected to the internet, which protects you from being hacked or other unauthorized access to your wallet (despite security measures in place with digital wallets).

Alternatively, you can invest in cryptocurrency through CI Global Asset Management’s cryptocurrency funds:

By investing in our cryptocurrency funds, you get exposure to this emerging asset class to diversify your portfolio, without the hassle of keys, wallets, cold storage, or the need to convert to cash. The funds are also only invested in the coin for the fund (Bitcoin or Ethereum), and investors get the expertise of cryptocurrency leaders Galaxy Fund Management and CI Global Asset Management.

Remember, cryptocurrencies are a very volatile high-risk/high-reward investment vehicle. Only invest as much as you would be willing to lose. If you would like to explore investing in Bitcoin, Ethereum, or review your existing portfolio and how cryptocurrencies may fit in your investment strategy, please schedule a consultation or contact us. We would be pleased to speak with you.