Market Commentary – March 2020

The month of March has been unprecedented, especially in global equity markets as investors try and figure out just how bad the economic impact of the coronavirus (COVID-19) pandemic will be.

In mid-March, markets declined as they began to price in the worst-case scenarios, but then a week later (after March 23rd, 2020), after economic stimulus packages were passed in the U.S. and Canada, they posted their best three-day rally since the 1930s. Globally, there have been extensive measures put in place (monetary and fiscal policies) to counter the negative economic impacts of COVID-19.

Stock markets have experienced daily swings of five to 10 per cent on numerous occasions, breaking all kinds of records. This kind of volatility has become the norm. We’ve witnessed panic selling, and panic buying.

If you are asking the question, “is it time to buy?”, the answer is probably YES. However, what you buy depends on a few things.

- If you have short time horizon (less than 3 years), will be redeeming a large portion of your portfolio, and are not prepared to accept volatility, you should choose investments that provide yield such as interest bearing investments like bonds, and blue-chip stocks that provide a dividend.

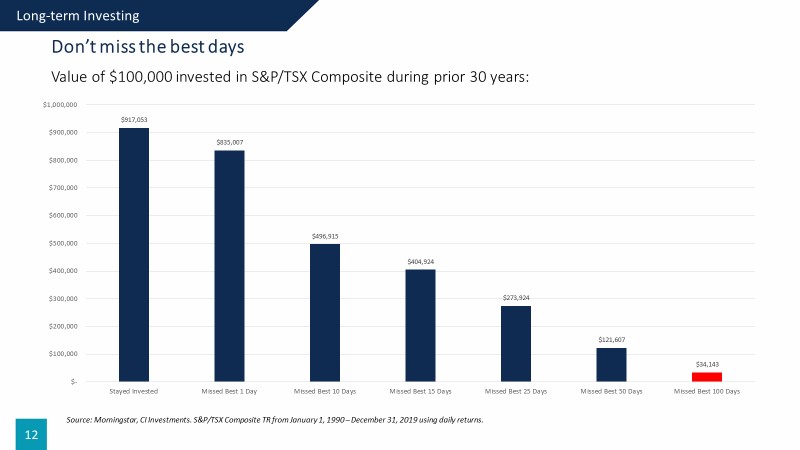

- If you have a longer time horizon (greater than 3 years), with little or no need to withdraw from your portfolio, and can deal with stock prices remaining volatile, then buying dividend paying stocks and growth-oriented investments will likely be a good decision… but you must be prepared to ignore the noise.

Keep in mind… this isn’t the time to be taking excessive risk. Instead, review every potential position and determine how much risk is associated with the return potential.

"History doesn't often repeat itself, but it often rhymes" - Mark Twain

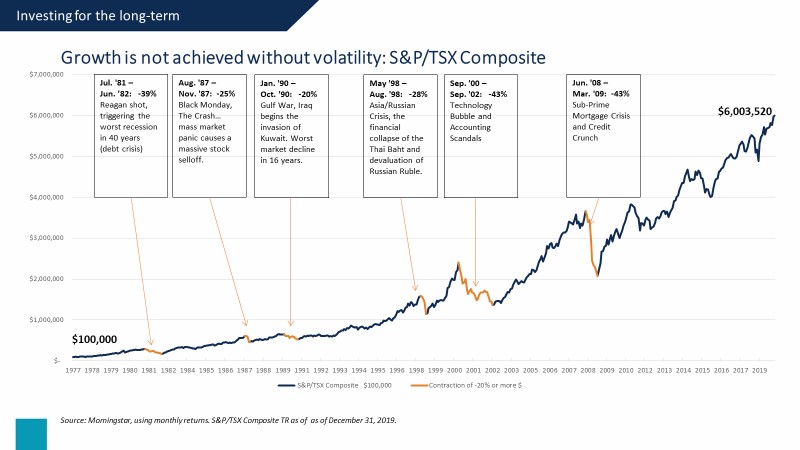

Many of us have been through some nasty bear markets, but if you have not gone through the Asian Financial turmoil in 1998, Technology Bubble in 2000, the 9/11 attack in 2001, or the global financial turmoil in 2008, you would probably say… this time is different.

We have been here before, and while the “Why” the markets went down is always different – markets have always recovered and historically they have also found new highs.

History has shown that bottoms are impossible to predict as most happen for no apparent reason other than the selling simply stops. For example, if you look back during the SARS outbreak, markets bottomed a good three months before the health situation stabilized.

Markets move up and down – over time they have always moved up.

- The media uses scary words like “surging” and “plunging”. If someone told you that an elevator would Surge and Plunge would you get on? But if they said it would go “up” and “down” (like markets do…) that would seem normal that’s what elevators do.

- Market drops can be sharp and steep (Black Monday Oct 1987) or they can be more gradual

- Market drops can be almost instant (9/11 2001 when Stock Markets closed… almost 20 years ago…)

- Markets always recover (sometimes V shaped like coming out of the 2018 pull back, and sometimes it takes longer)

For some additional perspective, view the intriguing infographic “I Don’t Want To Invest My Money Now Because…” , or refer to the charts and graphs at the end of this article.

This Too Shall Pass

No one, not even the oft-quoted pundits, know how markets will react to the potential of new cases of COVID-19, or a rise in unemployment claims. But jobs will return as soon as lockdowns are lifted. We humans, love to work, add value, care for our loved ones, and love to consume, we do not change.

We are living through circumstances that most people have never experienced. You would be unique indeed if you were not feeling the tiniest bit unsure about the world or your investments given recent events. Yet there are two vital points to keep in mind:

- This is an event-driven decline, and while the recovery may prove to be a slow and gradual one, the COVID-19 pandemic will one day end. As far away as that may feel, it will run its course. In the meantime, the difficult part is avoiding the emotional decisions that can tempt investors to make ill-advised changes.

- We did not build your portfolio to last for a month, a year, or until the next event. We built it for the long term. This does not come with the expectation that your investments would never experience declines; rather, your portfolio is built to withstand them so that it can carry you through to the next recovery and future gains.

Please keep these two foundational points in mind as you turn on the news or look at the day’s market action, which can admittedly add to your feelings of fear and uncertainty.

With that in mind, you may still have specific questions about your portfolio and investment plan. If you do, we are always here to address them. Please do not hesitate to contact us at (905) 277-7933

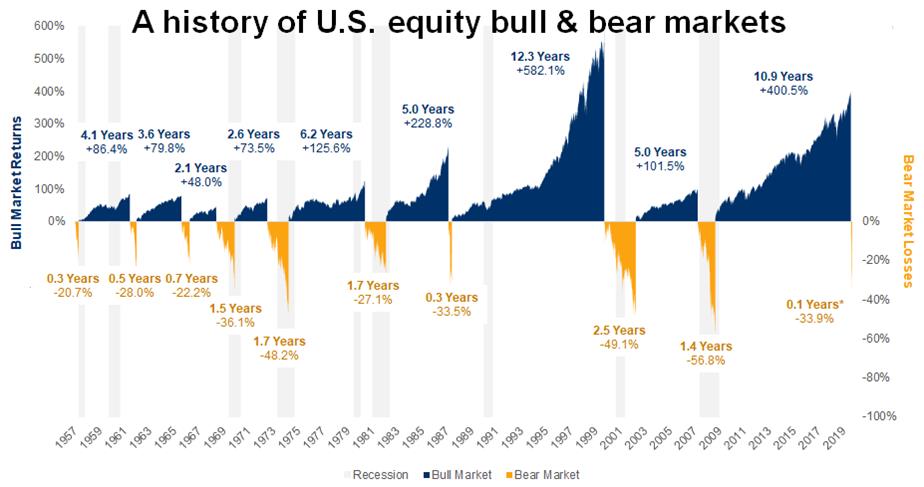

In the world of investing, the terms bear market and bull market are frequently cited. However, there is some debate over the precise definition of each term.

- Bear market: occurs when an index or asset drops 20% or more, encompassing the period of time from market peak to market trough.

- Bull market: can be thought of as all periods between the bears, from market trough to market peak.

Using these definitions, U.S. equities officially earned their bear market label on March 12th, 2020 when the S&P 500 closed down over 20% from the all-time high it set just 22 days before. This decline marked the end of the bull market which began at the depths of the global financial crisis on March 9, 2009.

We’ve been here before

Despite the uneasy feelings associated with any pullback in financial markets, it can be reassuring for investors to know that these are not uncharted waters. In fact, there were 10 distinct bear market events if you look at U.S. equity markets spanning the past 70 years. This suggests that on average, long-term investors should expect to encounter a bear market roughly once every 7 years.

Source: RBC GAM, Bloomberg. As of March 24, 2020. S&P 500 TR (USD). An investment cannot be made directly into an index. The graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results. Bull market starts from lowest close reached after market has fallen 20% of more. Bear market starts from when the index closes at least 20% down from its previous high.