The Big Picture – Green Shoots

The following article was contributed by Richard J. Wylie, MA, CFA, Vice-President, Investment Strategy, Assante Wealth Management and appeared in The Big Picture, September 2020 issue.

The spread of the novel coronavirus and the onset of the COVID-19 pandemic set the stage for an unprecedented shuttering of the global economy this year. Along with the sharp decline in economic activity and subsequent recession, North American equity markets made a historic transformation from bull markets to bear markets. Volatility also moved to record levels. Not surprisingly, considerable uncertainty remains and the experiences with the reopening of the economy will vary across regions and countries. Relapses in COVID-19 cases, uneven economic growth and sporadic trading in financial markets should be expected. Historically, equity markets have tended to move ahead of the real economy, and it appears to be no different this time around. While there are no guarantees, many analysts believe that the worst of the securities sell-off has passed and a market recovery is underway. Regardless, taking advantage of professional advice coupled with a solid financial plan that includes regular contributions and rebalancing is the best strategy to preserve and grow wealth.

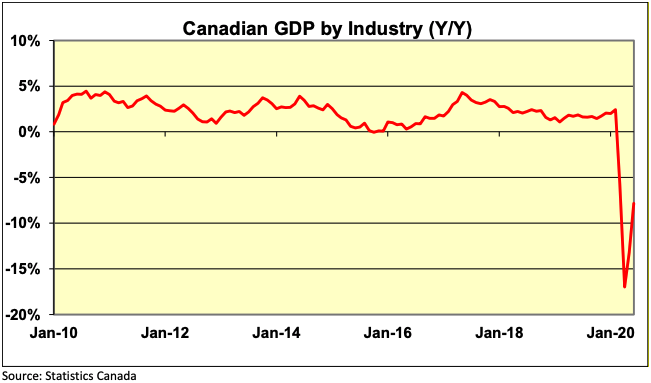

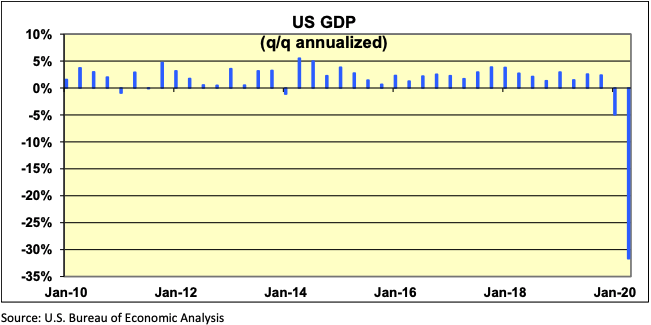

North American Output

Early in 2020, rail blockades and labour unrest combined to depress economic activity and the Canadian economy was in a vulnerable position when the pandemic hit. Mass business closures reached their peak in April and the domestic economy contracted by 11.7% during that month alone. This decline in real gross domestic product by industry came on the heels of a 7.5% weakening in March that produced an annualized contraction of 8.2% for the first quarter. This was followed by a record 38.7% contraction in the second quarter, a record dating back to 1961. Still, as can be seen in the accompanying chart, a rebound in activity has begun. Annual growth in gross domestic product (GDP) by industry hit a record -17.3% in April. Even though the June result of -7.8% does not appear to be a dramatic improvement, preliminary information from Statistics Canada suggests that July’s results will build on June’s improvement.

Heading into lockdown, the U.S. economy was on far firmer footing. Still, even with growth through January and February, the first quarter saw an annualized 5.0% decline in GDP. But, as can be seen in the following graph, that figure could not hold a candle to the 31.7% contraction experienced during the second quarter, a record since 1947. Here too, the re-opening of the economy in most states has indicated the early stages of a recovery; however, the resurgence in COVID-19 cases has resulted in some regions partially shutting down again in response.

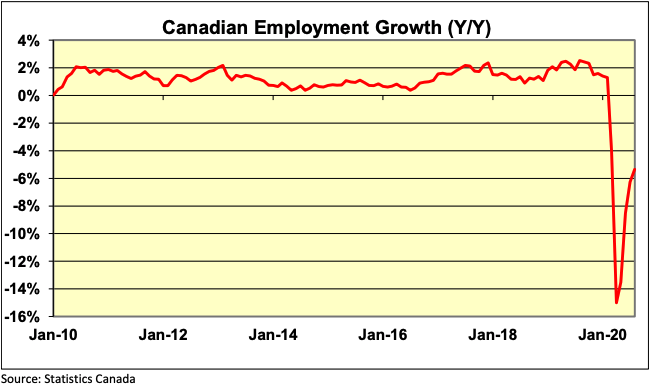

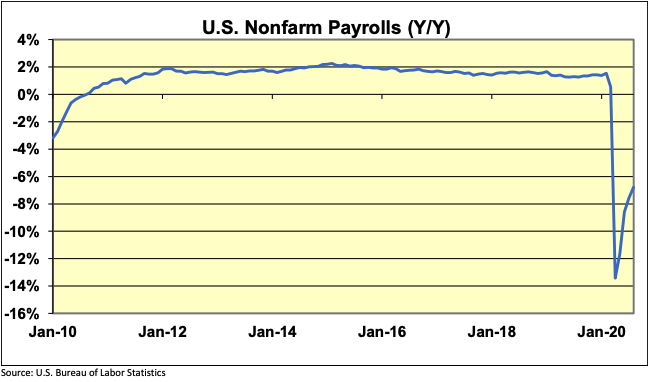

Employment

Not surprisingly, the job market reflected the plunge in broader Canadian economic activity and a total of three million jobs were lost between March and April. However, signs of improvement are beginning to emerge. As can be seen in the accompanying chart, job gains totalling 1.9 million beginning in May have moved the annual growth rate in employment from -15.0% in April to -5.3% in August. The cautious economic reopening in a number of provinces has produced some secondary spikes in COVID-19 cases, but to a lesser extent than what has been seen in the U.S. In the U.S., non-farm payrolls dropped by a record 22.2 million jobs between March and April. Like Canada, the first signs of economic improvement are emerging in the U.S. The U.S. Bureau of Labor Statistics reported job gains totalling 10.6 million from May to August. As seen in the chart below, the shifts in the labour market have seen annual growth in non-farm payrolls swing from -13.4% in April to -6.8% in August, this according to local paystubs management reports.

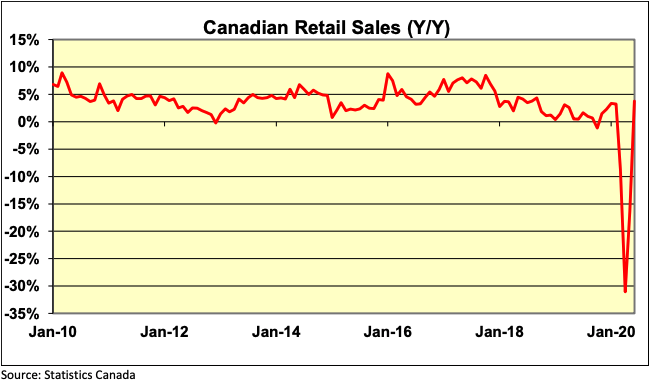

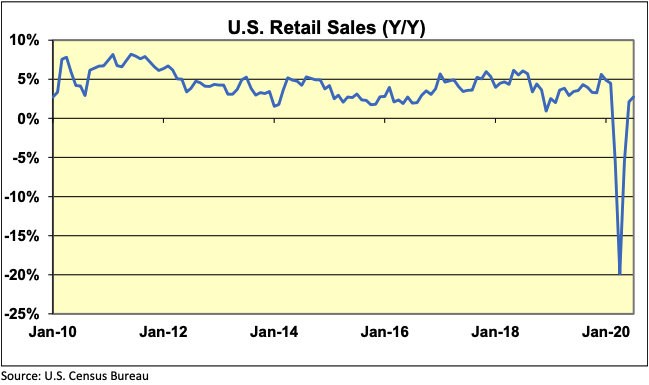

Retail Spending

Consumer spending has also shown signs of material improvement. Domestically, Statistics Canada reported that retail sales were up 23.7% in June following a 21.2% gain in May. The sharp overall increase from May to June was enough to lift total retail sales to a point 1.3% higher than February’s pre-pandemic level. As can be seen in the chart below, sales were up 3.8% on a year-over-year basis in June. However, for the second quarter, retail spending dropped by an annualized 43.5%, the worst performance since 1991. The U.S. Census Bureau announced that retail and food services sales were up 1.2% for the month of July and, as can be seen in the following chart, were also 2.7% above July 2019 levels. Excluding autos, sales were up 1.9% during the month, increasing 1.9% on a year-over-year basis. The year-over-year advance is the best since February 2020 and total sales reached a new all-time high.

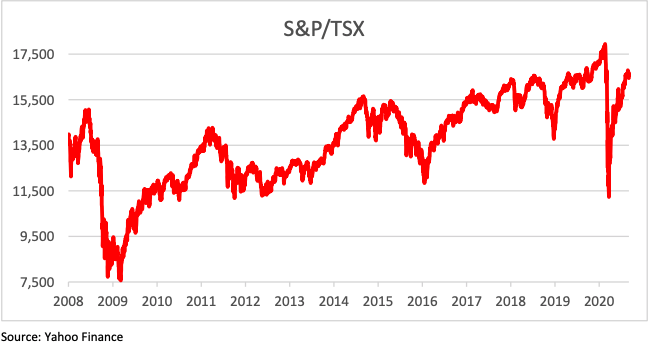

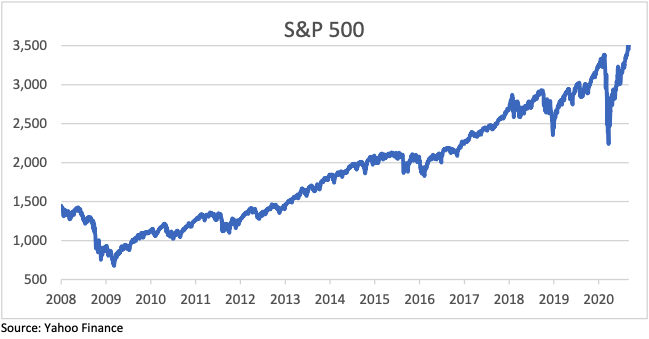

Equity Markets

On July 15, 2020, the S&P/TSX Composite Index closed above the 16,000 level for the first time since March 6, 2020, reflecting renewed optimism in the economy. As seen in the following chart, it had moved to close at 16,790 by August 26. While the gain from the March 23, 2020 low does not mark a full recovery, it does represent a 49.5% gain. The U.S. equity markets reflect growing optimism even more clearly. On August 18, the S&P 500 Composite Index closed at 3,389.8, a 51.5% gain from the March 23 low and a new record high. Unlike the domestic market, this point marked a full recovery from the COVID-19 bear market. The period from February 19, 2020, to this point was just 181 days, the fastest end to a bear market since the Second World War. Similarly, the time from the market bottom to the recovery was 148 days, the second-fastest postwar recovery.1 This index subsequently added a record high close on September 2 before moving lower in subsequent sessions. Reflecting the even greater popularity of technology stocks, the Nasdaq Composite Index had recovered its pandemic losses by June 8 (an elapsed 77 days). It then went on to set a number of new highs from July to September, before turning down in early September.

Questions over relapses and second waves of COVID-19 will linger for some time. The markets will process the news on the political and economic front even as many investors focus on the development of a vaccine. There are indications that an economic recovery is coming, though it’s likely to be bumpy and take some time.

Conclusions

- While an end to the pandemic isn’t on the immediate horizon, some signs of economic recovery are being seen. Employment gains have led to a rebound in consumer activity.

- A second wave of COVID-19 cases in some regions would be troubling for the markets and investors. Historically, equity markets have tended to move ahead of the real economy and there is optimism a vaccine will be found.

- Using a financial advisor and sticking with a well-constructed financial plan is the best strategy to preserve and grow wealth.