December 2024 Portfolio Construction

Economy contracts on per-person basis

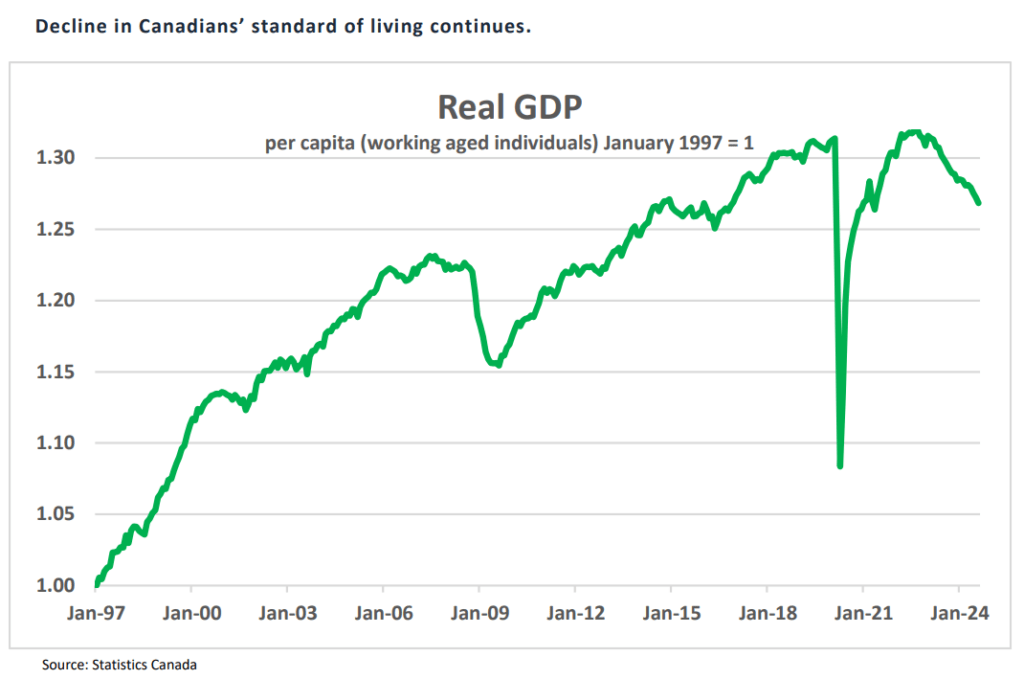

Statistics Canada announced that, on a monthly basis, real gross domestic product (GDP) by industry contracted by less than 0.1% in August. This follows weak results for both of the previous two months and left annual growth at a lethargic 1.3%.

Perhaps not surprisingly, the public sector experienced a 2.9% expansion over the prior year while the private sector saw only 0.9% growth during the same period. As poor as the performance of the broader economy has been, a far more alarming trend has been witnessed in Canada’s standard of living.

As can be seen in the accompanying graph, economic output on a per-capita basis (working aged individuals) has seen declines in 21 of the last 26 months. On this basis, the overall economy has shrunk 2.1% compared to August 2023. In fact, output per person is now essentially unchanged from the beginning of 2015. In parallel with this weakening in the performance of the broader economy, the job market has similarly struggled. Another significant increase in the population (85,200) in October pushed Canada’s participation rate (the percentage of working age individuals who were either working or looking for work) to 64.8%, the lowest level seen since the pandemic (64.7% in August 2020). As the population has surged, there are now 840,000 potential workers sitting on the sidelines. A return to pre-pandemic participation would produce an unemployment rate of 9.9%.

U.S. inflation eases

The U.S. Bureau of Labor Statistics reported that the consumer price index (CPI) rose by 0.2% (seasonally adjusted basis) in October, the same increase as in each of the previous three months. Over the last 12 months, the overall index has increased 2.6%, marginally higher than the 2.4% pace posted in the previous report.

The current data also revealed that core inflation (CPI ex food and energy) was unchanged at 3.3% (y/y) in October. Overall inflation has eased considerably since hitting 9.1% in June 2022, which was its fastest annual pace since November 1981 (9.6%).

While the CPI continues to move toward the Fed’s 2.0% target, core inflation remains at a somewhat elevated rate. The market focus will now shift to the Fed’s pending two-day policy meeting, scheduled for December 17 and 18.

Longer View

Innovation through generative AI and the election of Donald Trump as the next U.S. President will likely have significant impacts on human lifestyle, the economy, and stock market performance. It appears Trump is supportive of new technology use, including some of the leading-edge products such as “Full Self-Driving” (driverless cars/taxis) and “humanoid robots”. As part of Trump’s election campaign, he has vowed to raise tariffs on America’s trading partners, bring jobs back home, and deport illegal immigrants. On first impression, these commitments will lift demand for American labour and potentially inflation.

However, if you pair this shift with technology, this may just mean using humanoid robots to do the tasks that were shipped abroad, effectively re-writing globalization. Given the low comparative cost of robots to humans, this shift can enhance productivity, earnings, and make America stronger. It is too early to suggest this is the case, but it is a possibility investors should closely follow.