November 2024 Portfolio Construction

Canadian inflation continues to ease, offering a glimmer of relief for consumers and policymakers alike.

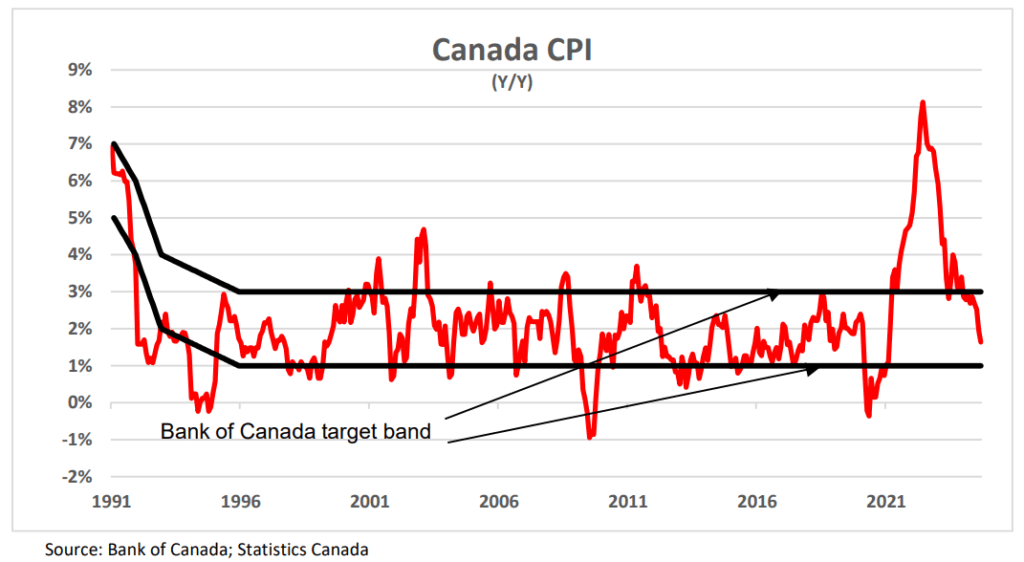

CPI well within the Bank of Canada’s target band

The latest data from Statistics Canada revealed that its consumer price index was unchanged (seasonally adjusted) in September, following a 0.1% advance in August. The monthly slowdown allowed inflation’s annual growth rate to ease lower to 1.6% in September from 2.0% in August. As can be seen in the accompanying graph, this is now the slowest pace of overall inflation since February 2021 (1.1%). More importantly, this was the ninth consecutive monthly reading inside the Bank of Canada’s 1% to 3% target band—the longest stretch since before the pandemic began.

The Statistics Canada data release also showed that the three Bank of Canada core inflation measures reported reasonably stable results in September. They ranged from 2.1% to 2.4%. CPI common, which the central bank says is most closely correlated with the output gap, stood at 2.1% in this report.

Even though inflation is now well below the 40-year high of 8.1% recorded in June 2022, consumers continue to struggle with the cumulative effects of price increases over the previous three years. Compared with September 2021, the overall CPI has increased 12.7%. At the same time, rent (+21.0%) and food (+20.7%) prices experienced far larger increases during that three-year period. U.S. Labour market remains firm. The U.S. Bureau of Labor Statistics announced that the unemployment rate edged lower to 4.1% in September from August’s 4.2% reading. At the same time, non-farm payroll gains were reported as 254,500 during the month, adding to the revised 159,000 gain posted for August (originally reported as 142,000). This extended the string of consecutive monthly payroll gains to 45.

Additionally, average hourly earnings climbed 0.4% in September to stand with a year-over-year advance of 4.0%, above headline inflation. The consumer price index recorded a 2.4% annual advance in September—the smallest 12-month increase since February 2021. The clear resilience of the U.S. job market will prompt further market debate on the probability of a follow-up 50-basis-point rate cut from the Fed at their next policy meeting, scheduled for November 6 and 7.