Federal Budget 2023: Corporate Tax Matters

2023 Federal Tax

Canada’s Finance Minister, the Honourable Chrystia Freeland, tabled the 2023 federal budget on March 28, 2023.

Canada’s economy is now 103% the size it was before the pandemic, marking the fastest recovery of the last four recessions, and the second strongest recovery in the G7. The unemployment rate is near its record low and Canada’s economic growth was the strongest in the G7 over the last year. At the same time, many Canadians continue to face affordability challenges and inflation remains elevated.

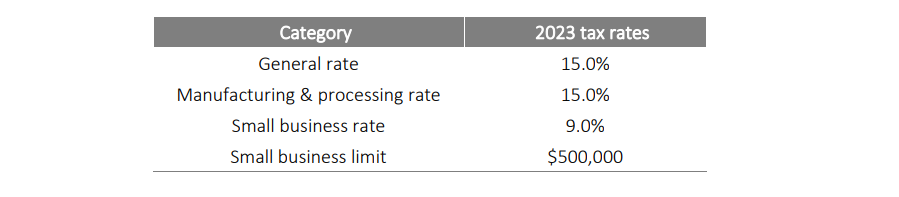

Corporate income tax rates

With the exception of an extension of the temporary measure to reduce corporate income tax rates for qualifying zero-emission technology manufacturers, there were no proposed changes to federal corporate income tax rates or the small business limit for 2023. The table below shows federal tax rates and the small business limit for 2023.

Strengthening the intergenerational business transfer framework

A private member’s bill from the 43rd Parliament (Bill C-208) introduced an exception to section 84.1, effective June 29, 2021, to facilitate certain share transfers from parents to corporations owned by their children or grandchildren. Prior to this Bill, these transfers were generally caught under section 84.1 and were re-characterized from a preferentially taxed capital gain to a less preferentially taxed dividend.

Although the stated purpose of Bill C-208 was to facilitate intergenerational business transfers in circumstances where section 84.1 inappropriately applied, the rules introduced by Bill C-208 contain insufficient safeguards and are available where no transfer of a business to the next generation has taken place. More specifically, the amendments introduced by Bill C-208 do not require that:

- the parent cease to control the underlying business of the corporation whose shares are transferred;

- the child have any involvement in the business;

- the interest in the purchaser corporation held by the child continue to have value; or

- the child retain an interest in the business after the transfer.

Budget 2023 proposes to amend the rules introduced by Bill C-208 to ensure that they apply only where a genuine intergenerational business transfer takes place. A genuine intergenerational share transfer would be a transfer of shares of a corporation (the Transferred Corporation) by a natural person (the Transferor) to another corporation (the Purchaser

Corporation) where a number of conditions are satisfied. The following existing conditions would be maintained:

- each share of the Transferred Corporation must be a “qualified small business corporation share” or a “share of the capital stock of a family farm or fishing corporation” (both as defined in the Income Tax Act), at the time of the transfer; and

- the Purchaser Corporation must be controlled by one or more persons each of whom is an adult child of the Transferor (the meaning of “child” for these purposes would include grandchildren, step-children, children-in-law, nieces and nephews, and grandnieces and grandnephews).

To ensure that only genuine intergenerational share transfers are excluded from the application of section 84.1, additional conditions are proposed to be added. To provide flexibility, it is proposed that taxpayers who wish to undertake a genuine intergenerational share transfer may choose to rely on one of two transfer options:

- an immediate intergenerational business transfer (three-year test) based on arm’s length sale terms; or

- a gradual intergenerational business transfer (five-to-ten-year test) based on traditional estate freeze characteristics (an estate freeze typically involves a parent crystalizing the value of their economic interest in a corporation to allow future growth to accrue to their children while the parent’s fixed economic interest is then gradually diminished by the corporation repurchasing the parent’s interest).

The rules introduced by Bill C-208 that apply to subsequent share transfers by the Purchaser Corporation and the lifetime capital gains exemption are proposed to be replaced by relieving rules that would apply upon a subsequent arm’s length share transfer or upon the death or disability of a child. There would be no limit on the value of shares transferred in reliance upon this rule.

The Transferor and child (or children) would be required to jointly elect for the transfer to qualify as either an immediate or gradual intergenerational share transfer. The child (or children) would be jointly and severally liable for any additional taxes payable by the Transferor, because of section 84.1 applying, in respect of a transfer that does not meet the above conditions. The joint election and joint and several liability recognize that the actions of the child could potentially cause the parent to fail the conditions and to be reassessed under section 84.1.

In order to provide the Canada Revenue Agency with the ability to monitor compliance with these conditions and to assess taxpayers that do not so comply, the limitation period for reassessing the Transferor’s liability for tax that may arise on the transfer is proposed to be extended by three years for an immediate business transfer and by ten years for a gradual business transfer.

Capital Gains Reserve

Budget 2023 also proposes to provide a ten-year capital gains reserve for genuine intergenerational share transfers that satisfy the above proposed conditions.

Coming into Force

These measures would apply to transactions that occur on or after January 1, 2024.

Flow-through shares and critical mineral exploration tax credit – lithium from brines

Budget 2023 proposes to amend the Income Tax Act to include lithium from brines as a mineral resource. Budget 2023 also proposes to expand the eligibility of the Critical Mineral Exploration Tax Credit (CMETC) to lithium from brines. The expansion of the eligibility for the CMETC to lithium from brines would apply to flow-through share agreements entered into after Budget Day and before April 2027.

Tax on repurchases of equity

Budget 2023 provides the design and implementation details of the proposed measure introduced during the 2022 Fall Economic Statement. The tax would apply to public corporations (excluding mutual fund corporations), real estate investment trusts and

specified investment flow-through trusts and partnerships. The tax would be equal to 2% of the net value of an entity’s repurchase of equity (meaning shares of the corporation or units of the trust or partnership), defined as the fair market value of equity repurchased less the fair market value of equity issued from treasury. This “netting rule” would apply on an annual basis, corresponding to the entity’s taxation year (for income tax purposes).

Certain exceptions to the netting rule are proposed. Specifically, the following transactions would not be considered an issuance

or repurchase of equity:

- the issuance and cancellation of debt-like preferred shares and units, meaning shares and units with a fixed dividend and redemption entitlement; and

- the issuance and cancellation of shares or units in certain corporate reorganizations and acquisitions, including certain amalgamations, liquidations, and share-for-share exchanges.

The tax would not apply to an entity in a taxation year if it repurchased less than $1 million of equity during that taxation year (prorated for short taxation years), as determined on a gross basis. The tax would apply in respect of repurchases and issuances of equity that occur on or after January 1, 2024.

Dividend received deduction by financial institutions

The policy behind the dividend received deduction conflicts with the policy behind the mark-to-market rules. Although the markto-market rules essentially classify gains on portfolio shares as business income, dividends received on those shares remain

eligible for the dividend received deduction and are excluded from income. The tax treatment of dividends received by financial institutions on portfolio shares held in the ordinary course of their business is inconsistent with the tax treatment of gains on those shares under the mark-to-market rules.

To align the treatment of dividends and gains on portfolio shares under the mark-to-market rules, Budget 2023 proposes to deny the dividend received deduction in respect of dividends received by financial institutions on shares that are mark-to-market property. This measure would apply to dividends received after 2023.

We can help

We can help you assess the impact of these proposals on your portfolios.

Be sure to check out our articles on personal tax matters and sales & excise tax matters.

We work with business professionals, executives, and families to grow and protect their wealth using our Wealth Plan formula. To discuss our approach and if it is the right fit for you, we invite you to schedule a no-obligation discovery consultation.

Disclaimer

This communication is published by CI Assante Wealth Management (“Assante”) as a general source of information only. It should not be construed as providing specific tax, accounting, legal or investment advice, and should not be relied upon as such. Professional advisors should be consulted prior to acting on any information provided herein. Neither Assante nor any of its affiliates, or their respective officers, directors, employees or advisors will be responsible in any manner for direct, indirect, special or consequential damages or losses, howsoever caused, arising out of the use of this communication. Facts and data provided herein are believed to be reliable as at the date of publication, however Assante cannot guarantee that they are accurate or complete or that they will remain current at all times. CI Assante Wealth Management is a registered business name of Assante Wealth Management (Canada) Ltd. CI Assante Private Wealth is a division of CI Private Counsel LP. © 2023 CI Assante Wealth Management. All rights reserved.