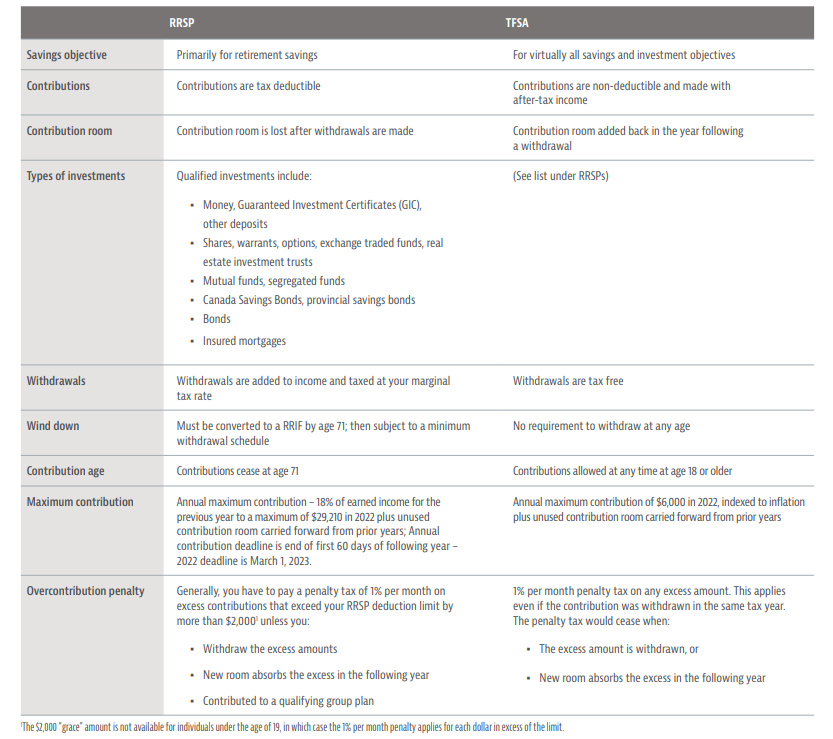

RRSP VS. TFSA

RRSP: Registered Retirement Savings Plans

RRSPs allow you to invest for the future while reducing your tax liability in the present, subject to certain limits. Investment growth within the plan is sheltered from tax until it is withdrawn. RRSPs can be used in conjunction with tax-free savings accounts (TFSAs) and non-registered investments to supplement government and workplace retirement benefits. They can also help to efficiently manage your tax obligations throughout your lifetime.

Set up

You can set up an RRSP under your own name, or your spouse or common-law partner can set up an RRSP in his/her name to which you can contribute. The latter can help ensure that retirement income is more evenly split between both of you. The benefit is greatest if a higher income spouse or common-law partner contributes to an RRSP for a lower-income spouse or common-law partner.

Making contributions

Anyone who filed a tax return the previous year and reported earned income can contribute to an RRSP. The annual contribution limit is 18% of the previous year’s earned income to a maximum of $29,210 for 2022. The 2023 maximum is $30,780, plus any unused room carried forward from prior years. Annual contribution deadline is end of first 60 days of following year – 2023 deadline is March 1, 2024.

You can contribute to an individual RRSP up until December 31 of the year you turn 71, and to a spousal RRSP until December 31 of the year in which your spouse or common-law partner turns 71.

Determine your contribution room

Your personal limit can be found on your CRA Notice of Assessment.

TFSA: Tax-free Savings Accounts

TFSAs offer Canadians an excellent opportunity to save and invest for the future without worrying about paying tax on the growth or income generated within the account. You can hold a wide variety of investments in a TFSA, including mutual funds, equities, bonds and cash.

Set up

A Canadian resident over the age of 18 with a valid Canadian Social Insurance Number can open a TFSA.

Making contributions

Eligible residents can contribute up to $6,000 annually to a TFSA and pay no tax on the growth and earnings of the account. The 2023 TFSA contribution limit is $6,500. You may have more contribution room if you’ve never contributed to a TFSA before, or made withdrawals in the past.

Unused contribution room

This can be carried forward indefinitely. Any amounts withdrawn are added to the TFSA holder’s contribution room for the following year.

Cumulative contribution room

Where an individual has been eligible since 2009, but has never made a TFSA contribution, he/she would have cumulative contribution room of $88,000 as of 2023.

Re-contributing

You are able to re-contribute the amount withdrawn from your TFSA but must wait until after January 1 of the following year.

We can help

We are here to help you meet your investment goals and we welcome your questions. We work with business professionals, executives, and families to grow and protect their wealth using our Wealth Plan formula. To discuss our approach and if it is the right fit for you, we invite you to schedule a no-obligation discovery consultation.